Data from scanned T5013 slips can be imported into Personal Taxprep using CCH Scan and the AutoFlow technology.

Data from the following scanned slips and forms can also be imported: T3, T4, T4A, T4A(P), T4A(OAS), T4PS, T4RIF, T4RSP, T4A-RCA, T4E, T5, T776, T1204, T2125, T2200, T2200S, T2202, T5006, T5007, T5008, RC62, RC210, RRSP, PRPP, T10, T215, T101, TL11, SSA 1042S, GRP Certificate, as well as most Québec RL slips.

You can visit our Web site for more information on this product.

T5013 – Statement of Partnership Income

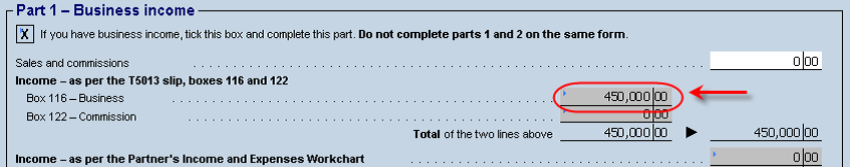

To enter the amounts on a T5013 slip, you have to use the section entitled “T5013 – Data entry” which is above the listing of all of the various generic codes that may appear on a T5013 slip. This section allows you to type in the box number, country or province code (when applicable) and the amount. This amount will then update to the appropriate cell below the section.

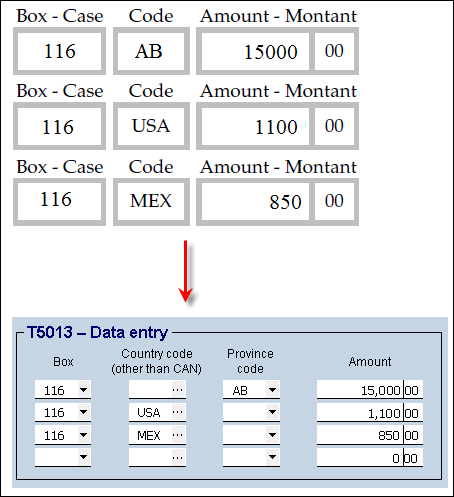

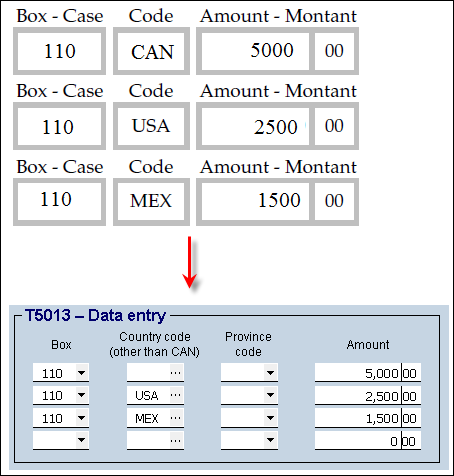

Here is an example of how data must be entered:

Please note that the “CAN” (Canada) country code does not have to be entered on the screen.

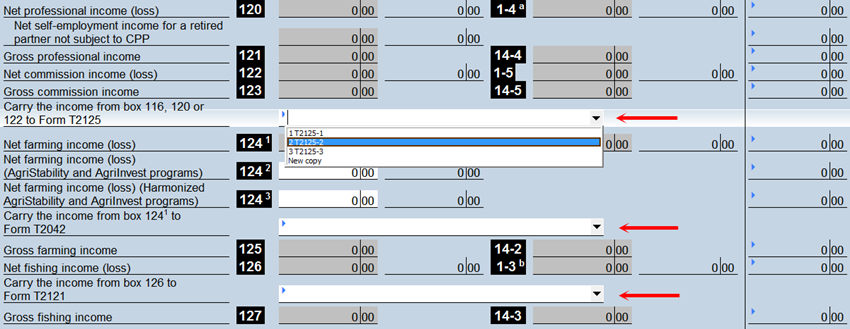

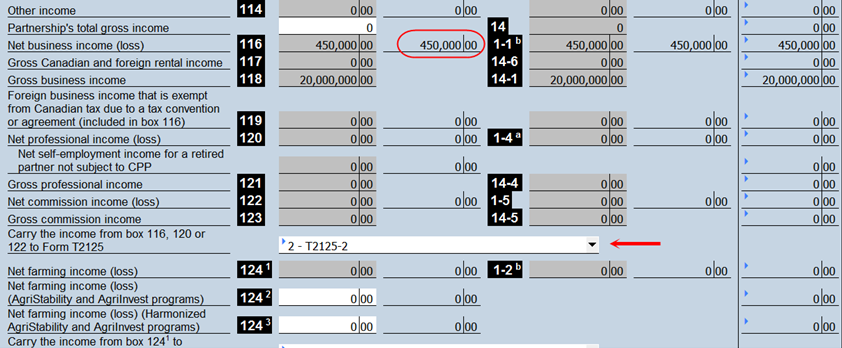

Taxprep allows you to transfer self-employment income from boxes 116, 120, 122, 124 and/or 126 of the T5013 slip to a self-employment statement (T2125, T2121 or T2042). The choice of the destination statement is performed using a drop-down menu which lists all of the self-employment statements (created beforehand) to which the transfer can be done:

To transfer the income to a self-employment statement, the destination statement must be selected:

The partner’s share in the net self-employment income allocated by the partnership is then transferred to the selected statement as being the partner’s gross income.

If you want to report additional income, like GST/HST and QST rebates for partners received in the year, or deduct expenses from income allocated by the partnership, the Partner’s Income and Expenses Workchart (Jump Code: PARTNER) allows you to detail the income and expenses. When you complete this workchart, Taxprep prompts you to link it to the appropriate self-employment statement, with the result that the income and expenses entered in this workchart will update to the self-employment statement.

If you do not want to detail the partner’s expenses, you can use the “Calculation of your share of the partnership net income (net loss)” section in the appropriate self-employment statement. This section may not, however, be used to enter additional income, except for GST/HST and QST rebates for partners received in the year.

Complete the Partner’s Income and Expenses Workchart (Jump Code: PARTNER) if:

- an additional income has been calculated because of a fiscal year not ending on December 31; or

- a reserve has been calculated for the previous fiscal year.

In accordance with the text relating to line 12200 included in the Federal Income tax and Benefit Guide, the self-employment income in boxes 116, 120 and/or 122 of the T5013 slip is updated to the worksheet of line 12200 when:

- code 0 or 3, Limited partner, 1, Specified partner, or 6, Retired member paid under subsection 96(1.1) has been selected at box 002; or

- a tax shelter number is entered on the T5013 slip.

However, you can ignore the partner’s code and determine if the self-employment income is active or non-active by using the check box shown below. This box determines if income must be included on line 12200 or on lines 13500 to 13900 of the T1 return, regardless of the partner’s code entered in box 002 of the T5013 slip. This check box also has an impact on earned income for the purpose of calculating RRSP’s/PRPP's, child care expenses, the WITB, the disability supports deduction and various provincial credits.

However, if you chose to transfer this income to a self-employment statement, income shown on the slips is updated to the line relating to that statement on the T1 return (lines 13500 to 13900) and, therefore, this income will be considered to be active income.

Note that, regardless if the farming or fishing income must be considered as active or passive income, it is reported on 14100 and 14300 of the return. When the above check box is selected, this income will be considered as passive income.

The self-employment income of a retired partner can be included in boxes 101, 102, 103, 104, 116, 120, 122, 124 and/or 126 of the T5013 slip, this income is updated either to the worksheet of line 12200, or to one of lines 13500 to 14300 of the T1 return depending on the requirements described in the above section.

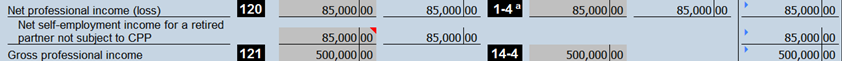

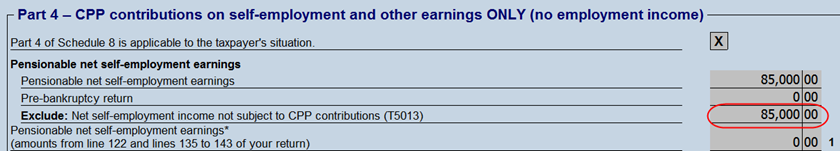

The self-employment income of a partner is not subject to CPP. When code 6, Retired member paid under subsection 96(1.1), has been selected at box 002, the net self-employment income is automatically entered in the appropriate box:

The income entered in box Net self-employment income for a retired partner not subject to CPP is updated to Part 4 - CPP contributions on self-employment and other earnings only (no employment income) of Schedule 8.

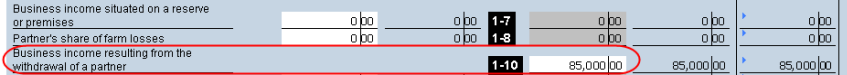

For a retired partner who received an RL-15 slip, ensure that the amount in box 1-10 has been entered in order for the income to be updated correctly to line 28 of Schedule L.

Multiple jurisdictions

T2203 – Automatic allocation to each jurisdiction

Enter the actual amount of eligible dividends in box 132 and the actual amount of dividends other than eligible dividends in box 129. The program calculates the taxable amount and updates this amount to the worksheet Investments, Statement of Investment Income, Carrying Charges, and Interest Expenses (Jump Code: INVESTMENTS).

In the case where the income is from foreign sources, enter the country of source first. To do so, use the “Country code” search box. Then, enter the foreign income and foreign tax in the appropriate boxes identifying them based on the type of income (business, rental or investment). This data is carried over to the T2209 C form so that the software may calculate both the federal and provincial credit for foreign tax.

See Also

T5013-INST, Instructions for recipient