This workchart is for partners in a partnership:

- who want to deduct partner’s expenses;

- who want to add additional income to their self-employment income from a partnership; and/or

- for whom an additional income has been calculated or must be calculated because of a fiscal year not ending on December 31.

Taxprep allows you to transfer self-employment income from boxes 116, 120, 122, 124 or 126 of the T5013 slip to a self-employment statement (T2125, T2121 or T2042) in order to report additional income and/or deduct expenses as follows:

- Transfer the self-employment income from boxes 116, 120, 122, 124 or 126 of the T5013 slip to a self-employment income (T2125, T2121 or T2042).

- Link the Partner’s Income and Expenses Workchart (Jump Code: PARTNER) to the self-employment statement.

- Detail the additional income as well as the partners’ expenses in the Partner’s Income and Expenses Workchart.

This way, the additional income and expenses are automatically updated to the self-employment statement and the return is eligible for EFILE.

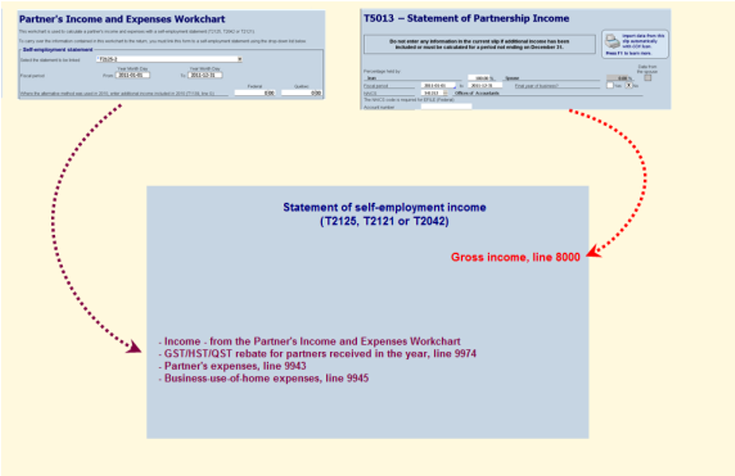

Here is a diagram showing how a partner’s income and expenses are reported based on this method:

Steps:

1. Transfer self-employment income from boxes 116, 120, 122, 124 or 126 of the T5013 slip to a self-employment statement (T2125, T2121 or T2042).

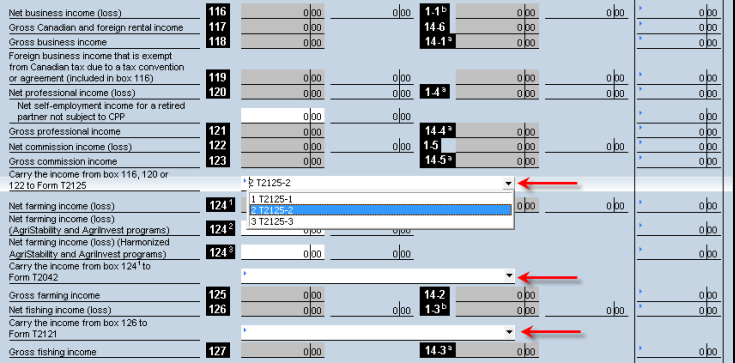

The choice of the destination statement is performed using a drop-down menu which lists all of the self-employment statements to which the transfer can be performed. Note that these statements must have been created beforehand:

To transfer partner’s income to a self-employment statement, the destination statement must be selected:

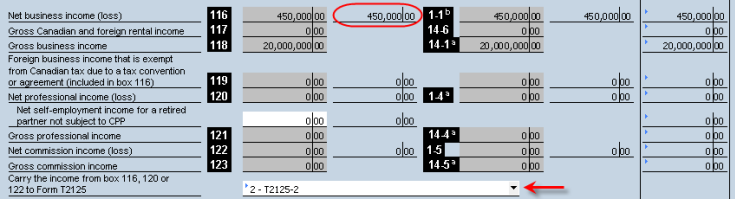

The partner’s share in the net self-employment income allocated by the partnership is then transferred to the selected statement as being a partner’s gross income.

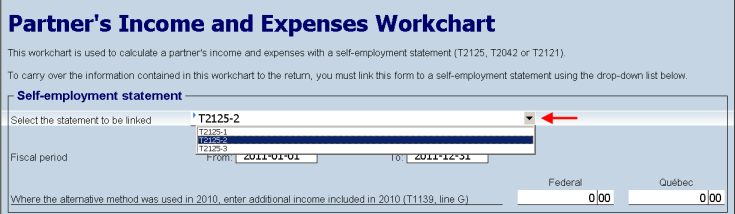

2. Link the Partner’s Income and Expenses Workchart (Jump Code: PARTNER) to the self-employment statement.

The benefit of using this workchart is that it allows you to include much more details than the “Calculation of your share of the partnership net income (net loss)” section, in particular with respect to capital cost allowance.

After having transferred the partner’s share of the partnership net income (net loss) from the T5013 statement to the self-employment statement, you must select the destination statement created to report the partner’s additional income and expenses using the appropriate drop-down menu.

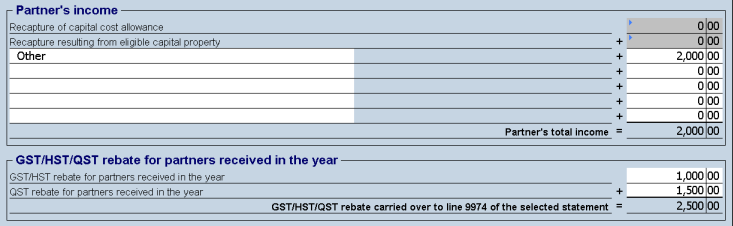

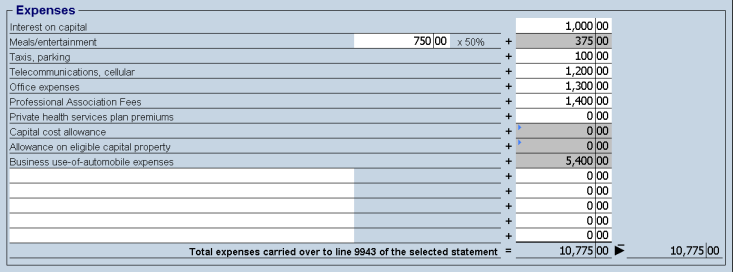

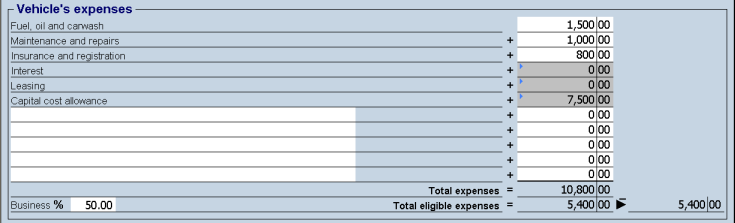

3. Detail the additional income as well as the partner’s expenses in the Partner’s Income and Expenses Statement.

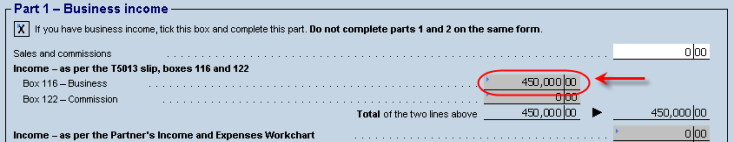

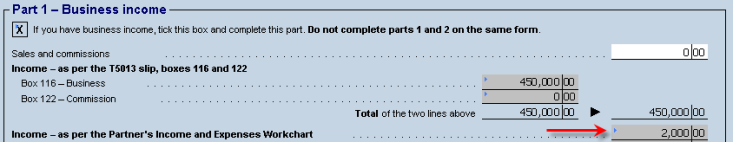

Income other than the rebates (GST/HST and QST) for partners received in the year will then be updated to the line Income – as per the Partner’s Income and Expenses Workchart from the selected self-employment statement (e.g.: T2125).

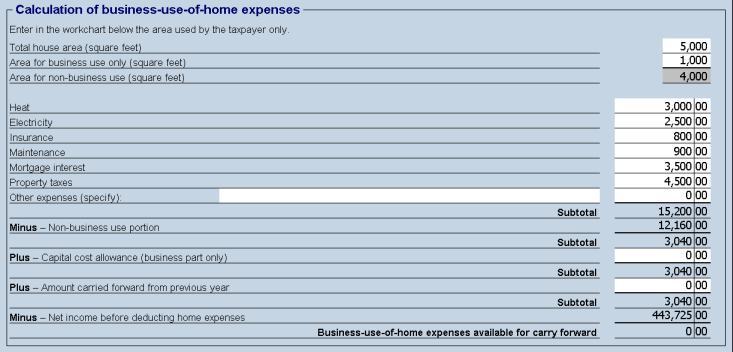

The amount of expenses deductible from the partner’s income (line 9943), business-use-of-home expenses (line 9945) as well as the GST/HST and QST rebate for partners (line 9974) will be updated to Section “Calculation of your share of the partnership net income (net loss)” of the selected self-employment expenses (e.g.: T2125).

See Also