To Begin

If you are using the program for the first time, begin by completing

the Tax

Preparer's Profile.

Enter client identification information in Form Client

Identification and Other Information (Jump Code: ID).

This form is selected by default when

the program is opened.

Form Tabs and Navigation Between Open Forms

Form Tabs

When a form is opened, a tab identifying it is displayed. When several

forms are opened, the tab related to the current form is highlighted darker

grey.

Form and Slip Navigation

You can display a specific form from among all opened forms. You can

click the form tab at the top of the screen or use one of the methods

found on the Forms menu - Last, Next Form, and Previous Form.

Preparing Slips

(Click a hyperlink to display help.)

- Enter the required information

about the employer or the payer in Form Client

Identification and Other Information (Jump Code: ID).

- Access the data entry

screen for the slip (for example, T4-RL-1

in the case of the T4 slip) and enter the information for each employee

or recipient.

Returning

Clients

Returning

Clients

For returning clients, roll forward data from last year. The

program will roll forward the permanent data (i.e.,

the information entered in Form Client

Identification and Other Information; the recipients T-slips and

RL slips identification data, and the identification data indicated on

the summary forms) for the slips, as well as for other forms. Once the

information is rolled forward, access the data entry

screen for the slip and enter the data for the current year for each slip

recipient. If there are new recipients, use the Multiple

Copy toolbar to insert a new slip.

Importing

Slip Information

Importing

Slip Information

Slip data can be imported if the information is found in a file saved

in .csv or .xls format.

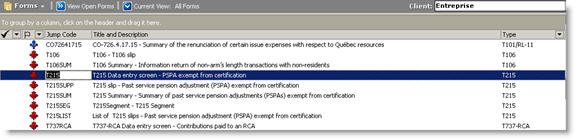

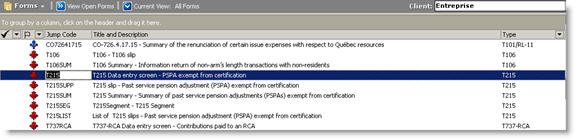

Searching

for Slips in the Program

Searching

for Slips in the Program

If you know

the slip number (the "Jump Code") of the slip you want

to complete, for example, T215

for the Past Service Pension Adjustment

Exempt from Certification, use the Form

Manager

to open the applicable data entry screen.

Entering Slip

Data

Entering Slip

Data

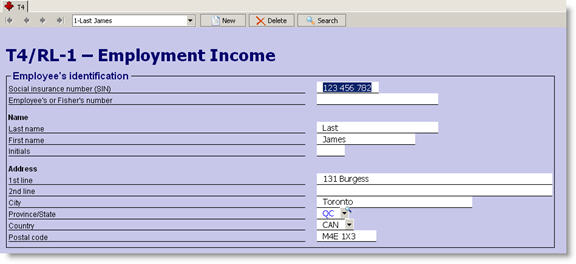

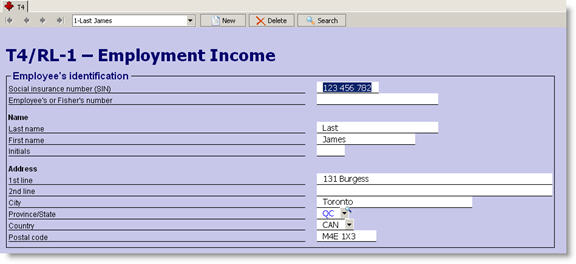

The Data Entry Screen

The entry of data required to complete slips (for example: the salary

and benefits received by the employee during the year, if you are completing

T4 slips) is performed in the applicable data entry screen. Use jump codes

(T4, T4A,

T4ANR, etc.) in the Form

Manager

to open the data entry screen required.

To enter data for a new slip, to access already completed slips or to

delete slips, use the Multiple

Copy

toolbar.

Corporate, employer or payer contact information is entered in the corresponding

summary form (Jump Codes: T4SUM,

T4ASUM, T4ANRSUM,

etc.) in the Form Manager.

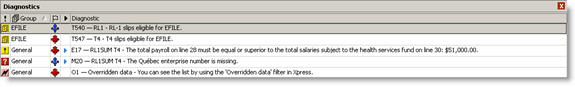

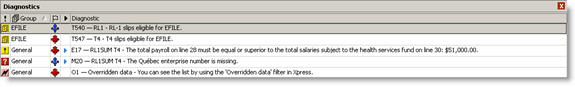

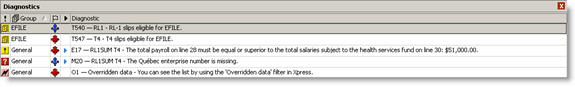

Diagnostics

Diagnostics

After entering information slips, be sure to consult the diagnostics.

Diagnostics indicate any possible errors and omissions in the file.

Viewing Slips

Viewing Slips

The Data Entry Screen

While the data entry screen or slip is displayed, you can navigate through

the slips entered using the Form Manager or the Multiple

Copy toolbar.

Use the Form Manager to display a list of all the slips entered in the

file or use the Multiple Copy

toolbar to navigate through and display slips one at a time.

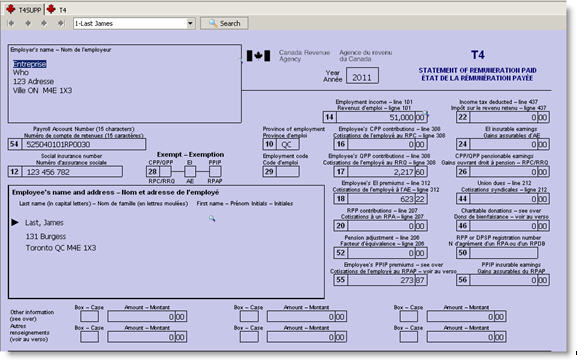

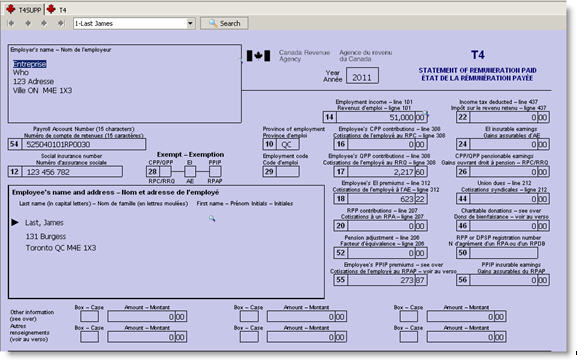

The Slip Display Screen (Jump

codes: T4Supp,

T4ASupp,

etc., in the Form Manager.)

This screen displays what slips would generally

look like when printed and is for viewing purposes only.

Changes are made on the associated data entry screen only. Scroll through

slips using the Slip Navigator.

Printing T-Slips

Printing T-Slips

Determine the printing options for the slips from the Print

Slips dialog box.

When you select File/Print

Slips, the Print Slips

dialog box displays. Use this dialog box to select the slips to print.

T4 and T4 Summary Characteristics

T4 and T4 Summary Characteristics

Canada

Pension Plan (CPP), Employment Insurance (EI) and Québec Pension Plan

(QPP)

Taxprep Forms calculates CPP/QPP

contributions and EI premiums based on the pensionable earnings (CPP/QPP),

the insurable earnings (EI) and the qualifying weeks of employment (CPP/QPP).

An adjustment mechanism is also available that you can choose to enable

or disable, at the bottom of the T4

Summary.

This mechanism can be used to adjust the contributions in the case of

over or under payment by compensating, as needed, with the income tax

amount withheld at source. However, this mechanism has not yet been approved

by the CRA or RQ.

Note: Boxes 24 and

26 of the T4 slip, as well as box G of the RL-1 slip, remain blank when

the insurable earnings (IE) or the pensionable earnings (CPP/QPP) correspond

to the salary entered in box 14 of the T4 slip or box A of the RL-1 slip,

or attain the maximum amount for the year in compliance with government

guidelines. In the case where insurable earnings (IE) or pensionable earnings

(CPP/QPP) differ from the salary, override box 24 or 26; the amount will

be displayed on the slip.

Benefits with Respect

to the Use of an Automobile

You can calculate the amount of benefits for the use of an automobile,

which must be added to an employee's income. To do this, double-click

box 34 in the T4-RL-1

Data entry screen

(you can also select this box and press F9). You will then access the

Personal use of employers auto

screen. Taxprep Forms will then

allow you to calculate the automobile benefit for each employee.

The amount of the benefit is added to the other income paid to the employee,

which you enter in the Remuneration and Benefits field. The total is entered

in box 14 of the Data entry screen and of the slip. The automobile benefit

is also entered in box 34 of the T4 slip. These amounts are posted to

the appropriate boxes of the Québec RL-1 slip.

T4 Summary

The T4

Summary

form supplies the total of the amounts entered on the T4 slips. The calculations

are performed by the program, so you only enter the amounts paid by the

employer over the course of the taxation year (line 82), the remittance

amount, if applicable, as well as all other information not yet entered.

At the bottom of the T4 Summary, in the boxed area, you can:

- Indicate that the data will be filed on magnetic

media support;

- Specify the employers Employment Insurance contribution

rate, if this rate differs from 1.4;

- Specify the sales tax to which the employer is

subject to for purposes of calculating the additional amount to remit

with respect to employee automobile benefits;

- Indicate if the employer is a large business , as defined in subsection 236.01(1) of the Excise Tax Act; and

- Enter notes for T4 slips and RL-1 slips.

Preparing Forms

(Click a hyperlink to display help.)

New Clients

New Clients

1. Enter the required

information about the employer or the payer in Form Client

Identification and Other Information (Jump Code: ID).

2. Access the data

entry screen for the slip (for example, T4-RL-1 in the case of the T4

slip) and enter the information for each employee or recipient.

3. Complete and print

the form. (See "Printing Forms" below.)

Note: See help for

each form by pressing F1 while the form is displayed.

Returning Clients

Returning Clients

For returning clients, roll forward data from last year. The

program will roll forward the permanent data (i.e.,

the information entered in Form Client

Identification and Other Information; the recipients T-slips and

RL slips identification data, and the identification data indicated on

the summary forms) for the slips, as well as for other forms. Once the

information is rolled forward, access the data entry

screen for the slip and enter the data for the current year for each slip

recipient. If there are new recipients, use the Multiple

Copy toolbar to insert a new slip.

Complete and print

the form. (See "Printing Forms"

below.)

Searching for

Forms in the Program

Searching for

Forms in the Program

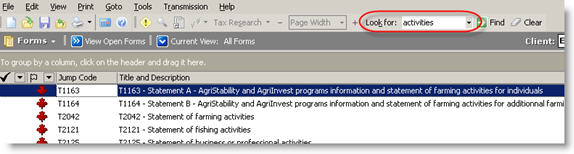

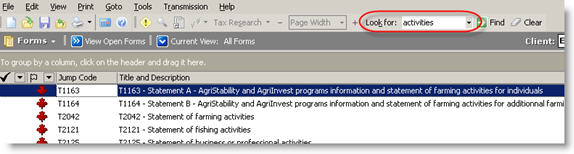

If you know

the form number (the "jump code") of the forms you want

complete, for example T2125 for the Statement

of Professional Activities, use the Form Manager to open your forms.

If you do

not know the form number, use the Search

dialog box. With this dialog box you can search for forms using any word

found in the form title. For example, "activities" from Form

T2125.

Entering Form

Data

Entering Form

Data

You can enter data in input fields which have black print on a white

background. Other field types have different properties and features.

Diagnostics

Diagnostics

After entering information slips, be sure to consult the diagnostics.

Diagnostics indicate any possible errors and omissions in the file.

Printing Forms

Printing Forms

You can print the current form, multiple forms and even blank forms.

Set print options and form selection defaults such as multiple copy settings

using File/Print Selected Forms

and File/Print

Based on Print Formats.

Completing Partnership Returns (T5013/TP-600)

Completing Partnership Returns (T5013/TP-600)

a. In the Form Manager,

click the Jump Code column and

type "T5013Sum" to find the Partnership

Information Return summary form. Either double-click or press Enter

to open the form.

b. If you are preparing

the Québec TP-600-V, Québec Partnership

Information Return, answer the question "If you want to complete

the Québec TP-600-V return and RL-15 slips, check Yes" at the top

of the form. Amounts entered on the T5013 Summary

will be transferred to the TP-600-V automatically.

c. Amounts entered

on page two of the summary are appropriately transferred to each T5013

or RL-15 slip.

d. Section C, Summary

of partnerships income (or loss) on page two of the summary includes posted

fields which, when double-clicked, will display the Reconciliation

of Net Income for Tax Purposes (T5013-S1) form. Be sure to select

the Type of income at the bottom of the T5013-S1 to transfer amounts entered

to the correct fields of the summary.

e. Options to determine

the "Basis for Allocation of Partners," "Allocation for

T5015," "Partnership's Capital Account" and "Other

Amounts to be Allocated to the Partners" can be found at the bottom

of page two of the summary form.

Use the jump code T5013RL15 in the Form

Manager to access the T5013/RL15

Data entry screen and enter each partner's information. As each partner

is added, income and other amounts are allocated according to your specifications

made on the T5013 Summary form.

- Viewing Partnership

Slips

View each completed T5013 or RL-15 slip

by opening the T5013SUPP or REL15 screen from the Form Manager. Changes

can only be made on either the Data entry screen or the summary.

Tax Help

Tax help is available for each form or slip found in the program. This

help includes details regarding the preparation of each form and slip,

filing requirements including addresses and, in many cases, hyperlinks

to the Web for relevant tax guides and other information. Press F1 while

a form is displayed to view the tax help for that form.

New

Clients

New

Clients

![]() Searching

for Slips in the Program

Searching

for Slips in the Program

![]() T4 and T4 Summary Characteristics

T4 and T4 Summary Characteristics

![]() Searching for

Forms in the Program

Searching for

Forms in the Program

![]() Completing Partnership Returns (T5013/TP-600)

Completing Partnership Returns (T5013/TP-600)