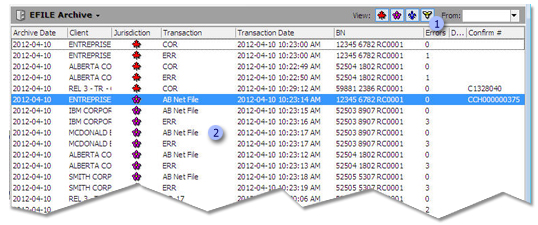

About the EFILE Archive View

The EFILE Archive view is used to keep track of electronic transaction information that is no longer current and that has been removed from the EFILE Log.

- To display the EFILE Archive view, click

, then EFILE Archive.

, then EFILE Archive.

|

|

Just as in the Client Manager and the Form Manager, tools are available to allow you to perform quick searches and customize the display of the EFILE Archive. |

|

|

The different columns displayed in the EFILE Archive view allow you to rapidly identify the archived transactions for a given client. |

Corporate Taxprep allows you to archive all of the electronic transactions relating to the selected client files. The archived items are found in the EFILE Archive view. When you choose to archive EFILE information, all transactions relating to a client file will be archived at the same time.

To archive electronic transactions from the EFILE Log, proceed as follows:

- On the Transmission menu, click Add to Archive.

- Select the From:

and To: dates.

Only transactions performed within that time period can be archived. - In the EFILE

Status area, select the status of the transmissions that you want

to archive.Note: While it is recommended that you only archive transactions relating to accepted client files, there may be instances where you want to archive other transactions (e.g. transmissions relating to a rejected file where the decision has been made to paper file).

- In the Jurisdiction area, select the jurisdiction of the transmissions that you want to archive.

- Click Apply

to generate the list of client files for which the EFILE transactions

can be archived.

If you decide not to archive the data for a specific client file, clear the check box beside this return. - Click OK.

- Your archiving frequency will depend on how your firm has organized its workload as well as the volume of electronic transactions. However, we suggest that you archive on a regular basis, whether it is daily, weekly, or monthly. If you have a large number of transactions appearing in the EFILE Log, then archiving a portion of the transactions will improve performance and reduce memory usage.

- You can configure the program to display a message prompting you to archive each time the EFILE Log reaches a specific number of entries.

Corporate Taxprep will display a message prompting you to archive electronic transactions when the EFILE Log contains a certain number of entries.

To set the number of entries held in the EFILE Log necessary for the message to be displayed, proceed as follows:

- On the Tools menu, click Options and Settings.

- Under Electronic Services, click General.

- In the Prompt to archive if the EFILE Log exceeds box under Archive settings, indicate the number of entries.

- Click OK.

-

Click the

button, then click EFILE Archive.

button, then click EFILE Archive. - On the

File menu, click Print

EFILE Archive.

The Print EFILE Archive dialog box displays. - Select the printer that you want to use.

- Modify the print settings, if applicable.

- To print the document to a PDF file, select the Print to PDF file check box.

- To modify the paper orientation, click Portrait or Landscape.

- Click OK.

All transactions displayed in the EFILE Archive will be printed. If you only want to print part of the transactions, you can use the filters available in the EFILE Archive headers to reduce the number of displayed transactions.

Electronic transactions stored in the EFILE Archive view can be restored in the EFILE Log. To restore any archived transactions, proceed as follows:

-

Click the

button, then click EFILE Archive.

button, then click EFILE Archive. - Select any transaction relating to returns for which you want to restore the EFILE information.

- On the Transmission

menu, click Restore.

All transactions relating to the selected returns will be automatically restored to the EFILE Log in a single operation.