Other information

Do you have a valid authorization or power of attorney?

The program automatically answers the question Do you have a valid authorization or power of attorney? based on the information entered in the form and the settings defined in the preparer profile used, in the section relating to Form MR-69 of the AUTHORIZATION FORMS tab.

The answer to this question will be “Yes”:

- if, in Form MR-69, the box You held a valid authorization or power of attorney in the previous year is selected;

- if, in Form MR-69, the date entered in the field “Consent expiry date rolled forward from the previous year” is not passed;

- if, in Form MR-69, a date is indicated in the field “Date the form was last submitted or previous year date entered in the "Signature" section”; or

- if, in the preparer profile used, the box Select the Yes check box for all existing clients at the question Do you have a valid authorization or power of attorney? is selected.

The answer to this question will be “No”:

- if you create a new client file;

- if, in the AUTHORIZATION FORMS tab of the preparer profile used, it is indicated that the form must be filed, and that, in Form MR-69, the date entered in the field “Consent expiry date rolled forward from the previous year” is passed;

- if, in the AUTHORIZATION FORMS tab of the preparer profile used, it is indicated that the form must be filed for deceased clients, and that a date of death is provided for the client; or

- if, in the AUTHORIZATION FORMS tab of the preparer profile used, it is indicated that the form must be filed, and that, in a copy of Form MR-69 without rolled forward data, no date is entered in the field “Consent expiry date rolled forward from the previous year” or in the field “Date the form was last submitted or previous year date entered in the "Signature" section.”

Date the form was last submitted or previous year date entered in the "Signature" section

The value that was entered in the “Signature” section of the form for the previous year will be rolled forward to the field “Date the form was last submitted or previous year date entered in the "Signature" section” of the “Rolled Forward Data” section. In this field, you will also be able to enter the date on which you have filed this form with Revenu Québec. The value in this field used to determine if you have an authorization or a power of attorney for the taxpayer.

The following instructions are taken from the form.

The term “person” refers to the person about whom Revenu Québec holds confidential information or documents. The person can be an individual, a deceased individual, an individual in business, a corporation, a partnership, a trust or an organization.

Part 2 is used to provide information about the designated person who is being granted an authorization or power of attorney (see the information regarding Part 4 for the definitions of authorization and power of attorney).

The term “designated person” refers to an individual (for example, a spouse) or a business (for example, an accounting firm). If the designated person is a business or a trust, be sure to enter on lines 13a and 13b the last name and first name of a person within the business or trust whom we can contact for more information.

If the designated person is a professional representative, he or she can access the person’s file online. In this case, you must enter the designated person’s professional representative number attributed by Revenu Québec (a letter followed by 6 digits) on line 16. Be sure to also enter the designated person’s Québec enterprise number (NEQ) on line 10 or his or her identification number on line 10a. If you do not know the professional representative number, request it from the designated person.

If you would like to grant a general authorization or power of attorney, check box 21 in section 3.1 and go to section 3.3.

However, if the authorization or power of attorney also applies to information or documents related to the Act to facilitate the payment of support, complete section 3.2.1, then go to section 3.3.

In addition, if the authorization or power of attorney applies to information or documents related to the shelter allowance program, check box 23 in section 3.2.2.

If you would like to grant a limited authorization or power of attorney, check one or more boxes in section 3.2.2 and provide any requested information.

You must specify the period(s), taxation year(s) or fiscal period(s) covered by the authorization or power of attorney in section 3.3. The period(s), taxation year(s) or fiscal period(s) can be in the past, present or future.

Support payments

If you complete section 3.2.1, you must enter the file numbers covered by the authorization or power of attorney and provide information about the taxation years covered in section 3.3.

Note that the authorization or power of attorney only covers support payment files that are in effect on the date the form is signed. If a support payment file comes into effect after that date, you must complete another copy of the form for this file.

Complete section 4.1 or 4.2, depending on whether this is an authorization or apower of attorney.

An authorization allows the designated person to consult confidential information and documents held by Revenu Québec that concern the person identified in Part 1, according to the options selected in Part 3.

A power of attorney not only gives the designated person access to such confidential information and documents, but also allows the designated person to act on the person’s behalf in dealings with Revenu Québec. For example, the person can communicate such as negotiations with Revenu Québec having to do with that regarding the information and those documents or requests ask that changes be made to the person’s tax file.

Note that the authorization or power of attorney is no longer valid where the person identified in Part 1 is deceased or found incapable of managing his or her affairs by the Superior Court of Québec. Where the person is found incompetent, his or her legal or authorized representative can designate the same person, or someone else, to act on the person’s behalf.

Note that this form will be returned to you if Part 5 is not signed.

In the case of an individual, this part must be signed by the individual or by the individual’s legal or authorized representative, who may be a tutor, a curator, a mandatary designated by a mandate in case of incapacity homologated by a court, a liquidator of a succession (estate), a trustee or any other person duly authorized through a power of attorney. The legal or authorized representative will have to provide documents proving that he or she is authorized to sign documents on the person’s behalf and to send Revenu Québec form LM-14-V, Information About a Representative.

If the person is a trust, a trustee must sign this part. If the person is a business, an authorized representative must sign this part. In the case of an individual in business, the individual must sign. In the case of a corporation, one of the officers (president, vice-president, secretary or treasurer) must sign. In the case of a partnership, one of the partners must sign. Note, however, that the authorized representative can be any other person who provides documents proving that he or she can sign for the business.

In the case of a corporation, if, in carrying out his or her mandate, a designated person wishes to sign a return, a certificate or any other document made by the corporation for the purposes of a fiscal law or regulations made under such a law, that person must be so authorized by a resolution of the board of directors of the corporation or by a unanimous agreement of the shareholders.

The authorization or power of attorney will take effect on the date it is signed and will remain valid indefinitely, unless a date is entered on line 52 or unless there are changes to be made to the information provided.

Note that if the designated person refuses to represent the person identified in Part 1, the designated person must so advise Revenu Québec in writing. In addition, under no circumstances may a designated person transfer the authorization or power of attorney to another person.

If space is insufficient on this form, you must enclose extra sheets containing the applicable information. Make sure you clearly mark on each appendix which part of the form the information pertains to.

In addition, where the form must be signed by more than one legal or authorized representative, you must enclose an appendix containing each representative’s name, signature and position, as well as the date of each signature.

The person who granted an authorization to communicate information or documents or a power of attorney is responsible for revoking that authorization or power of attorney if the person, or his or her legal or authorized representative, deems that it is no longer necessary. To revoke an authorization or power of attorney, complete form MR-69.R-V, Revocation of an Authorization to Communicate Information or of a Power of Attorney. You must complete a separate copy of the form for each person with regard to whom you wish to revoke an authorization or power of attorney. To revoke an authorization or a power of attorney verbally and immediately, contact Revenu Québec. It could, however, require written confirmation.

You can electronically transmit a mandate (MR-69). To do so, first make sure that all statements of the checklist are set to Yes. The electronic transmission checklist is comprised of two steps:

Step 1 – Printing the form: In this first section, all statements of the checklist are set to Yes before printing the form. Once printed, the mandate must be signed by the taxpayer and the professional representative.

A check box (60) is shown at the bottom of Part 4 with respect to the signee consenting to the electronic transmission of the mandate by the professional representative. When this box is selected the taxpayer designates the electronic versions of these documents as constituting legal originals.

IMPORTANT: The box must be selected in order for the electronic receipt of the mandate to be accepted and for the mandate to be in force. If the box is not selected, the transmission will be rejected.

If amendments must be made to data on the MR-69 form, we strongly suggest that you force the reprinting before the electronic transmission to make sure that the data on the hard copy (signed, scanned and attached to the client file) is identical to the electronically transmitted data, which will ensure that the mandate is in force.

Step 2 – Electronic transmission: The second section of the list relates to requirements that must be complied with to be able to transmit the MR-69 form:

- First, select the form for transmission. To select this option for all your clients, select the appropriate check box in the Revenu Québec section of the AUTHORIZATION FORMS tab of the preparer profile.

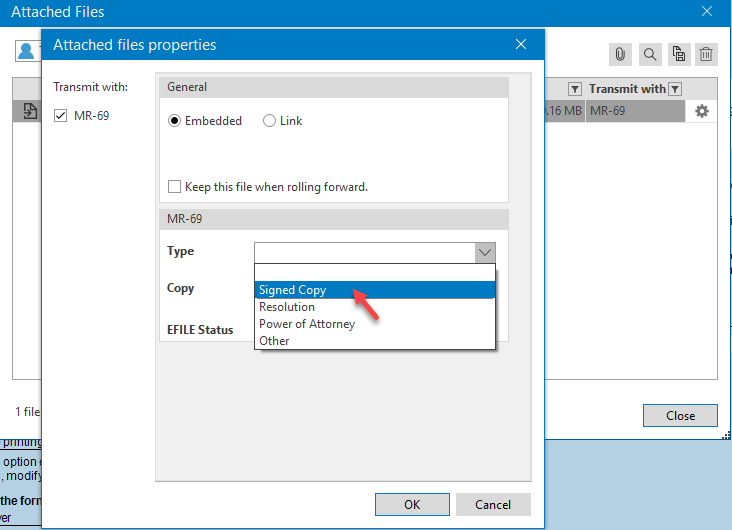

- Then, the signed mandate must be scanned and attached* to the client file. From the File menu, click Attached Files. The Attached files properties box will open when the signed mandate is attached to the form. Next, select Signed Copy from the Type list.

-

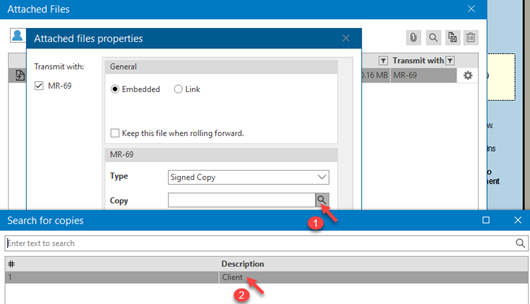

In the Copy field, click the magnifying glass and select the copy of the form to which the scanned mandate should be attached to. Then, click the OK button.

- In addition, if the signee is not the taxpayer*, a supporting document confirming that the signee is the legal representative of this taxpayer is required. This supporting document must also be attached** to the client file as the signed MR-69 form. In the Attached files properties box, select Resolution, Power of Attorney or Other from the Type list, as applicable.

* For a deceased taxpayer

If the deceased taxpayer’s liquidator has already sent EVERY document (will, search certificate from the Chambre des notaires du Québec and the Barreau du Québec, and Form LM-14) to show Revenu Québec that they are the liquidator AND that they received their letter confirming they are registered with Revenu Québec, no additional document will need to be provided; their MR-69-V form will be accepted as they are the recognized signatory.

If the liquidator has sent their documents but haven’t received their registration confirmation letter from Revenu Québec, their documents haven’t been processed or are missing. In that case, two options are possible:

- Add an additional attachment containing the required documents to register them as liquidator to be transmitted with Form MR-69-V;

- Wait for the liquidator to receive their confirmation letter from Revenu Québec.

If the liquidator has not sent anything to register with Revenu Québec, you must send an additional attachment containing the required documents to register them as liquidator.

If two or more liquidators must act jointly, Form MR-69-V must be signed by all liquidators; otherwise, the mandate will be rejected.

**The attached files will be transmitted to Revenu Québec at the same time as data from the MR-69 form.

The Eligible status value is allocated when all eligibility statements in step 2 are set to Yes. The transmission status displays automatically at the end of this section and can also be accessed using the File > Properties (F11) command.

The Accepted status value is allocated when the transmission of the MR-69 form is accepted by Revenu Québec. Once the value is allocated, the form will no longer be applicable when printing the return.

When the transmission of the MR-69 form is accepted, a reference number confirms only that the mandate was received by Revenu Québec and that it complies with some basic validations. To verify the validity of the mandate after having obtained the reference number, consult the My account portal for professional representatives (in French only) a few minutes after transmission. If the mandate has been accepted and is compliant, the status will be À accepter. In certain cases of exception, the mandate might be rejected for various reasons and the status will be À corriger. If this is the case, contact Revenu Québec.