Automatic calculation

It is possible to automatically complete a T1-ADJ form by modifying the active tax return. No need to manually indicate each of the lines of the tax return you want to modify: Personal Taxprep does it for you. The refund or balance due will be indicated at the bottom of the form, in the “Additional internal information” section.

The program automatically generates a corresponding adjustment request for the spouse, if applicable.

For Québec residents, the TP-1.R form is also automatically generated according to the same principle as the T1-ADJ form.

The program only calculates the impact of the adjustment on the tax return lines. If the adjustment does not modify the result of the tax return, but has an impact on the carried over balances (for example: the tuition fees or donations), manually complete the T1-ADJ form using the appropriate line in the list.

Manual calculation

To manually complete the T1-ADJ form, consult the drop-down list in the Name of line form return or schedule column and select the return’s line number affected by the adjustment request. The program automatically determines the corresponding line number in Form TP-1.R-V, if applicable.

The preparer must use this form to request an adjustment (i.e. a reassessment) to an individual income tax return. You can get more information about CRA's rules and policies for reassessments in Information Circular IC75-7R3, Reassessment of a Return of Income at canada.ca/en/revenue-agency/services/forms-publications or by calling 1-800-959-8281.

Part B of this form is usually completed by the preparer, however, when the form is completed by the taxpayer, you must enter an "X" in the applicable box at the end of Part B (Authorization).

He must provide a detailed description of each change he requests (he does not have to recalculate the tax amount).

If he is changing a line on which he already claimed an amount and he did not previously provide the supporting documentation, he now has to provide supporting documentation for the entire revised amount.

Supporting documents

|

If your tax services office is located in: |

Send your correspondence to the following address: |

|

Alberta, Manitoba, Northwest Territories, London, Saskatoon, Thunder Bay, Hamilton, Kitchener/Waterloo, Windsor, British Columbia, Yukon, and Regina |

Winnipeg Tax Centre

|

|

Toronto Centre, Toronto East, Toronto North, Toronto West, Barrie, Sudbury, Outaouais, Prince Edward Island, Belleville, Montréal, Ottawa, Sherbrooke, New Brunswick, Newfoundland and Labrador, Nova Scotia, Kingston, Peterborough, and St. Catharines |

Sudbury Tax Centre

|

|

Chicoutimi, Montérégie-Rive-Sud, Laval, Nunavut, Rouyn-Noranda, Québec, Rimouski, and Trois-Rivières |

Jonquière Tax Centre

|

|

Deemed residents, non-residents, and new or returning residents of Canada |

Sudbury Tax Centre or |

With ReFILE, you are transmitting an entire T1 return that has been amended to reflect the desired changes. You are not electronically filing a T1-Adjustment form.

However, in Personal Taxprep, we are using the automatic T1-Adjustment feature as part of the ReFILE process so that you can review the lines that have changed in the return and ensure that only the desired changes have been made.

Therefore, the process involved in preparing an amended T1 return will be similar to the process already in place to automatically prepare an adjustment. It is recommended that you use a copy of the data file for the original return when preparing an amended return.

Important information relating to the ReFILE service

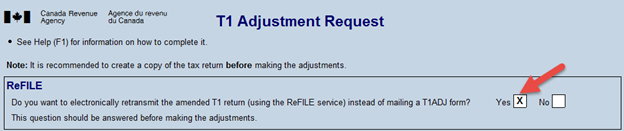

To electronically transmit an amended return, you must answer “Yes” in response to the question Do you want to electronically retransmit the amended T1 return (using the ReFILE service) instead of mailing a T1ADJ form? in the “ReFILE” section of Form T1 ADJ, T1 Adjustment Request (Jump Code: T1ADJ).

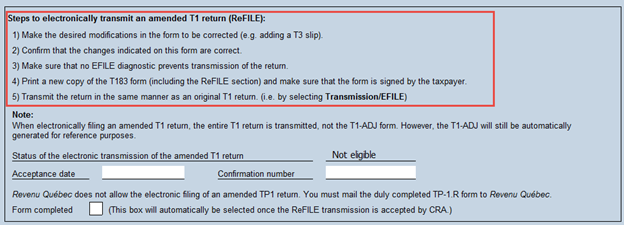

Once you respond yes to this question, the EFILE status of the return will no longer be “Accepted” and you can then modify the return to reflect the desired changes. Follow the steps on the T1-Adjustment form to electronically transmit an amended T1 return.

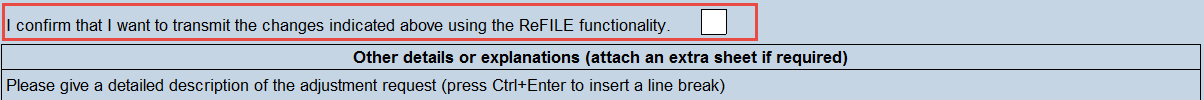

The lines that have been changed in the return will be displayed on Form T1-ADJ as will the anticipated change to the refund or balance due. You will need to confirm that the changes indicated are correct in order to transmit the return.

You may want to print Form T1-ADJ for reference purposes and/or to provide to the client, but the client does not need to sign Form T1-ADJ.

Instead, your client will need to authorize the transmission by signing a new copy of Form T183, Information Return for Electronic Filing and Individual’s Income Tax and Benefit Return.

You must then print Form T183, have the client sign it, and retain the original signed copy to be provided upon request.

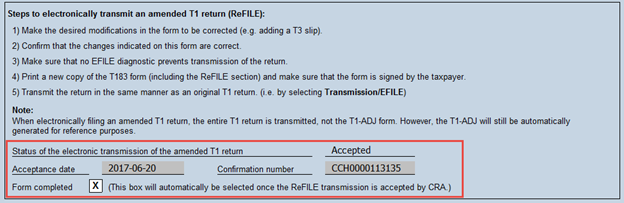

Once the client has provided authorization, you can transmit the return in the normal manner.

The confirmation number and date accepted will be recorded in both the Form T1-ADJ, T1 Adjustment Request as well as in the Form EFILE INFO, EFILE Information (Jump Code: EFILE INFO).

The EFILE exclusions that apply to transmitting original T1 returns also apply to transmitting amended returns. However, there are also some additional exclusions, including the exclusions that apply when using the Change My Return service via the Represent a Client portal. The EFILE diagnostics will identify amended returns that are not eligible for transmission.