For additional information and definitions of terms used in this form, see Guide T4037, Capital Gains.

How do you calculate a reserve

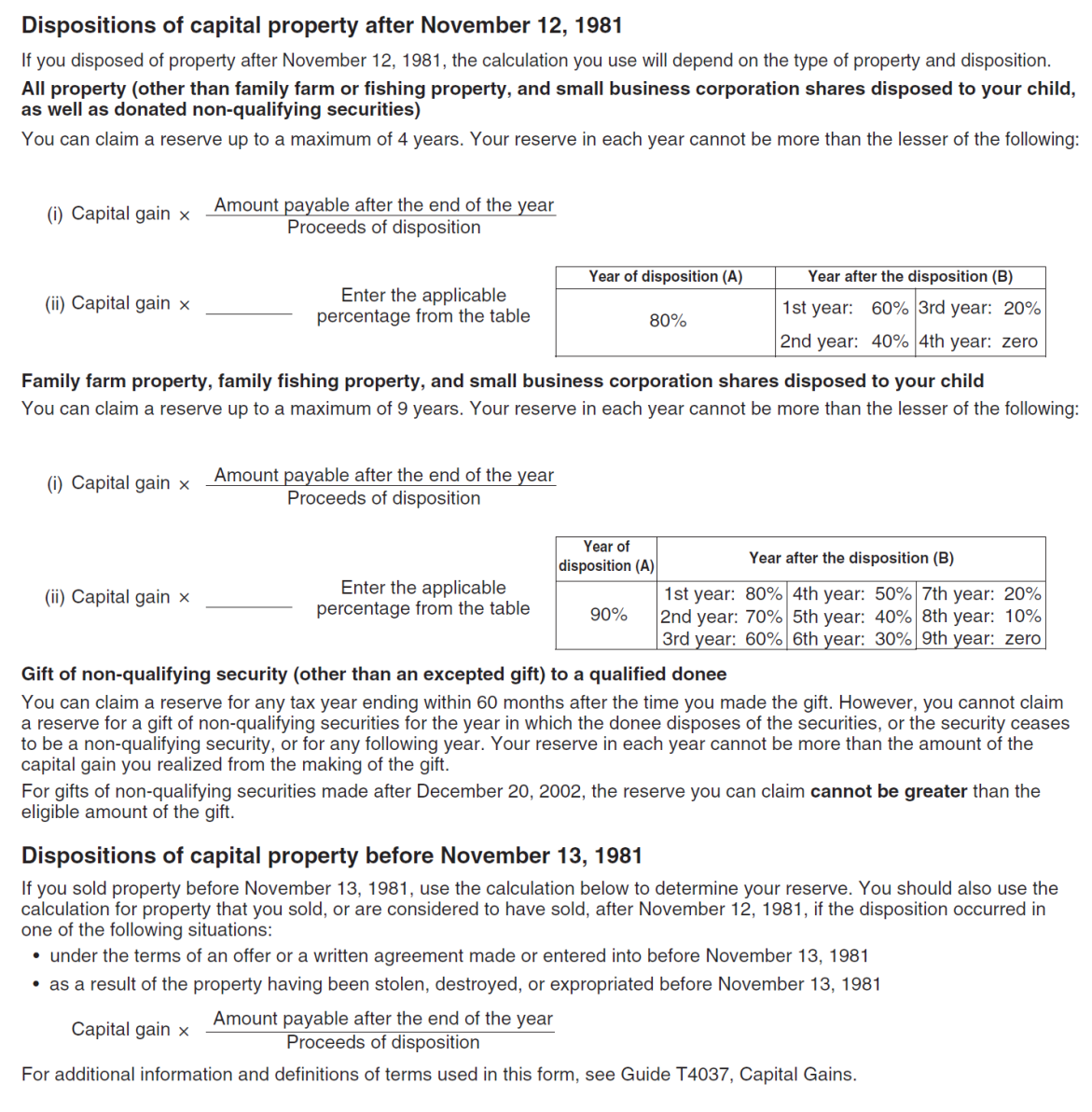

The reserve you can claim in a tax year depends on when you disposed of the property, and the type of property you disposed of. You do not have to claim the maximum reserve in a tax year (Year A). However, the amount you claim in a later year (Year B) cannot be more than the amount you claimed for that property in the previous year (Year A). To determine your maximum reserve for the current taxation year, use the calculation below that applies to you.

See Also