General Information

Unlimited Repeats

You can enter an unlimited number of properties in Schedule 3.

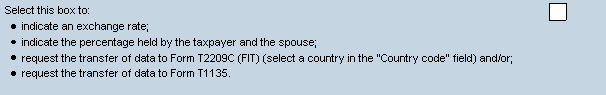

A check box is available at the top of each section to permit the allocation between the taxpayer and the spouse and/or permit the change in currency. By selecting this box, you will be able to access various fields in which you can enter the share, in percentage, of each spouse and/or the desired exchange rate.

You can enter the proceeds of disposition, adjusted cost base and the outlays and expenses in Canadian dollars or in a foreign currency. If you enter these amounts in a foreign currency, also enter the exchange rate applicable to the country where the disposition took place so the program can translate the values into Canadian dollars.

When the proceeds of disposition and the adjusted cost base originate from the ACB form and you have the choice to translate this data in Schedule 3, the exchange rate used will not display, because the data originating from the ACB form must be in Canadian dollars.

As a rule, the exchange rate used to translate the proceeds of disposition is the rate in force on the date when the disposition was realized, while the rate used to translate the adjusted cost base is the rate in force when the property was acquired. As these rates do not always suit the type of transaction carried out, you can also use the average exchange rates for the years in question.

The value of the translated proceeds of disposition, adjusted cost base and the outlays and expenses is shown on the line Your Share.

A transfer of data from Schedule 3 into Form T1135 can be made when the property subject of a disposition is specified foreign property that is part of the following classes:

- Publicly traded shares, mutual funds units, deferral of eligible small business corporation shares, and other shares

- Bonds, debentures, promissory notes, and other similar properties

- Real estate, depreciable property, and other properties

Note that no data is transferred if Part A, “Simplified reporting method,” has been completed in Form T1135.

In order for Taxprep to transfer the data, select the following box:

Then, in the Transfer to T1135 list, select the section of Form T1135 into which the income should be transferred.

Based on the section of Form T1135 selected for the transfer, the data transferred is the description, country code and the income (loss)/gain (loss) on disposition.

For more information, consult the Help for Form T1135.

When, in Schedule 3, a loss is identified as a superficial loss and information on the disposition originates from Form ACB, the ACB adjustment is automatically made in Form ACB for the affected property. The adjustment appears in the Adjustment (+/-) column of this form and corresponds to the loss that would have been calculated. This information transfer is done for the following asset categories:

- Qualified small business corporation shares

- Qualified farm property and qualified fishing property (shares)

- Publicly traded shares, mutual fund units, deferral of eligible small business corporation shares, and other shares

- Bonds, debentures, promissory notes, and other similar properties

Flow-Through Entities

Dispositions of an interest in or a share of the capital stock of a flow-through entity must be entered in Section 3.

To enter the dispositions for deferral of eligible small business corporation shares, use section 3 and select type 2: “Deferral of eligible small business corporation shares" to transfer data in the proper section of Schedule G.

Commencing in 2016, any taxpayer will have to report basic information relating to the disposition of a principal residence to qualify for this exemption.

Basic information includes the address, date of acquisition and the proceeds of disposition of the property. This information must be entered in the new “Principal residence” section of Schedule 3. Since more than one disposition could give entitlement to the partial exemption relating to a principal residence, the basic information can be entered for more than one residence.

In the “Principal residence” section of Schedule 3, individuals must also indicate if they designate the property/properties which were disposed of as having been their principal residence(s) for all of the years during which they owned such property or for certain years only.

A question has been added to the “Mailing address” section of the Identification form, so that you can indicate whether the taxpayer disposed of a property during the year, for which he or she is claiming the total or partial principal residence deduction. In rolled forward files where Personal Taxprep detects that there has been a change of address, a diagnostic prompts you to verify if there has been disposition of such property. The display of this diagnostic can be cancelled if you answer “No” to this question, or if you enter data in the “Principal residence” section of Schedule 3.

Commencing in 2016, a copy of Form T2091 will be created in Personal Taxprep for each disposition of a property whose basic information has been entered in the “Principal residence” section of Schedule 3. The basic information will be updated to the copy of Form T2091 created for this disposition. You will have to add further information on the copy of Form T2091 only when the property has not been designated as a principal residence in all of the years during which the taxpayer owned the property. Only the copies in which the additional information will have been entered will be applicable for printing purposes.

As in past years, Form T2091 Designation of a Property as a Principal Residence by an Individual (Other than a Personal Trust), only has to be enclosed with the return (or mailed to the CRA when the return was EFILED) when a capital gain results from the disposition of the property designated as the principal residence. Therefore, when the taxpayer designates a property as the principal residence for certain years (but not all of the years) during which he or she owned it, Form T2091 must be submitted.

Note that the reporting of a principal residence disposition applies to both the deemed dispositions and actual dispositions. Penalties are applicable in cases where the disposition of a principal residence was not reported. The CRA will accept late designations and dispositions reporting, but they could be subject to penalties.

For information about designating a principal residence and what qualifies as a principal residence, go to https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-127-capital-gains.html and select "Principal residence and other real estate", or see Chapter 6 of Guide T4037, Capital Gains, or Income Tax Folio S1-F3-C2, Principal Residence.

For information on how to report the gain or loss on a part of your principal residence you used to produce income, see the section "Real estate, depreciable property and other properties" in Chapter 2 of Guide T4037, Capital Gains, Capital Gains, and Income Tax Folio S1-F3-C2, Principal Residence.

Losses on listed personal property incurred in previous years must be entered, for a new client, in Form Continuity of Non-Capital Losses Carryforward (Jump Code: LOSS), in the appropriate section.

You may own shares of a qualifying small business corporation that becomes a public corporation by having its shares listed on a prescribed stock exchange in Canada. In this case, there is an election available to you. The election is an option that will allow you to report a capital gain on your income tax return and take advantage of the $866,912 capital gains deduction, even though you did not actually sell your shares. The deduction will apply to any gains you have on these shares to the date the shares are listed. To make this election, complete Form T2101, Election in Respect of Gains on Shares of a Corporation Becoming Public. You can get this form from your tax services office.

Section 3 is used to report dispositions of mutual fund units, deferral of eligible small business corporation shares, and other shares including publicly traded shares.

A flow-through entity is considered a conduit for Income Tax Act purposes. Income earned by such entities is flowed out to (i.e. taxed in the hands of) its members or investors. Common examples would be mutual fund trusts, investment corporations and partnerships.

In the 1994 tax return, an investor in a flow-through entity could elect to claim capital gains accrued to February 22, 1994. These could consist of capital gains earned by the flow-through entity (e.g. a partnership) or accrued gains on the units of the flow-through entity itself (e.g. a mutual fund). As a result of this election, the elected capital gain was included in income, a capital gains deduction was claimed and an "exempt capital gains balance", equal to the elected gain, was created.

Subsequent capital gains which are passed on from the flow-through entity (e.g. reported on a T-slip) or realized as a result of the disposition of the units of the flow-through entity are reduced by any available exempt capital gains balance.

An exempt capital gains balance from one flow-through entity cannot, however, be used to offset gains from another flow-through entity, since there is a separate exempt capital gains balance for each flow-through entity.

You should consider the following points when using the program:

Use Section 3 to enter the data with regard to dispositions of flow-through entities.

Disposition of all Interest in the Entity

Paragraph 53(1)r) of the Income Tax Act (ITA) allows, on disposition of all the taxpayer's interest in a given flow-through entity, to increase the adjusted cost base of the taxpayers interest by an amount equal to his unused balance of exempt capital gains with regard to that interest. Paragraph 53(1)r) of the ITA recognizes the possibility, retroactive to 1994, that the value of an interest in a flow-through entity may have fallen since February 22, 1994 and allows for that loss of value to be recognized.

If the taxpayer disposed of all interest in the flow-through entity, the adjusted cost base you entered on Schedule 3 must reflect the unused balance of the capital gains account with regard to that interest. The program makes no adjustment in this regard.

To enter the dispositions for resource property, use section 3 and select type 3, “Resource property – QC,” to ensure that the data is transferred to the correct section of Schedule G.

Section 4 is used to report dispositions of real estate property.

Since a capital loss cannot be claimed on depreciable property because it is a terminal loss, enter a checkmark if the disposition concerns depreciable property in order for the amounts to be posted to Schedule 3 without granting a loss.

Section 5 allows you to enter the dispositions of bonds, debentures, promissory notes, and other similar properties.

Generally, virtual currency transactions give rise to capital gain or loss or self-employment income or loss.

To enter the dispositions of virtual currency transactions giving rise to a capital gain or loss, in Section 5, select the box Select this box to enter the information relating to virtual currency transactions and select type 2, Virtual currency transactions - Qc, in order for data to be transferred to the correct section of Schedule G. You must also enter the number of units and the method of disposition in Section 5.

The adjusted cost base and the proceeds of disposition of a personal-use property are deemed to be at least $1,000 for the purpose of calculating the capital gain. However, the $1,000 deemed adjusted cost base and deemed proceeds of disposition for these property will not apply for property acquired after February 27, 2000 as part of an arrangement in which the property is donated as a charitable gift.

Impact of rules relating to the eligible transfer of a family business as the result of Bill C-208.

As a result of the changes made to s. 84.1 of the Income Tax Act by Bill C-208, an eligible disposition of qualified small business corporation shares and shares of the capital stock of a family farm or fishing corporation by an individual to a corporation that is controlled by one or more of the individual’s children or grandchildren who are 18 years of age or older will be deemed to be a non arm’s length transaction for dispositions after June 28, 2021. As a result, the transaction will not be subject to the deemed dividend rules in s. 84.1 and for federal purposes, such a transaction should be treated in the same manner as a disposition of such property to an arm’s length party and entered on Schedule 3 accordingly.

However, for Québec purposes, the transaction will still be treated as non-arm’s length, although a portion of what would otherwise have been a deemed dividend may be deemed to be a capital gain on Form TP-517.5.5. A check box has been added to Part 1 and 2 of Schedule 3 to identify these transactions for Québec purposes and when this check box is selected, a diagnostic will remind the preparer to complete Form TP-517.5.5.

See Also

T657 – Capital Gains Deduction