When a taxpayer ceases to be a resident of Canada, Canada Revenue Agency deems that he or she, when leaving Canada, disposed of nearly all his or her property at FMV and that he or she immediately acquired them once more for the same amount.

The capital gains (or loss) incurred as a result of this deemed disposition must be reported in the return of the year of departure for the residency period.

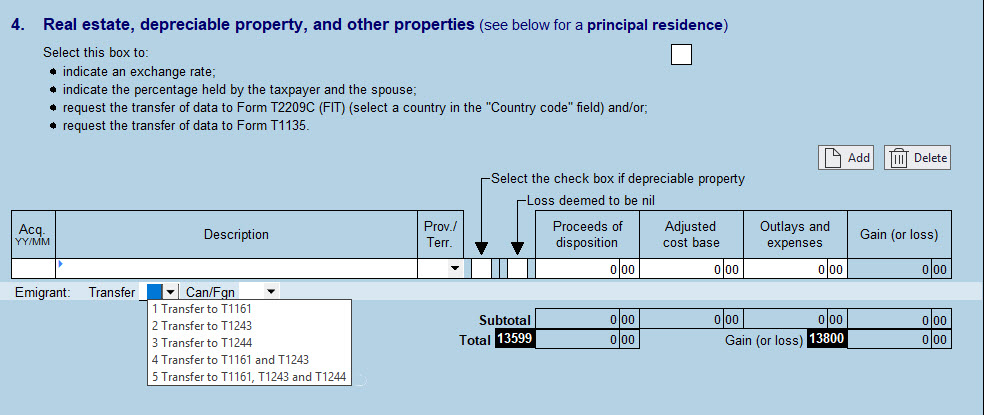

When you complete Schedule 3, Summary of Dispositions – Capital Gains (or Losses) to determine the capital gains (or loss) incurred by the taxpayer due to real or deemed dispositions, be sure to select T1161 or T1161 and T1243 or T1161, T1243 and T1244, if applicable, from the drop-down list of the Transfer column. Similarly, select (C) or (F) from the drop-down list of the Can/Fgn column to indicate whether it is Canadian or foreign property.

The Transfer and Can/Fgn columns for emigrants become available in Schedule 3 as soon as you indicate a date of departure in the “Residence” section of the Identification form for this taxpayer.

Therefore, certain data entered in Schedule 3 will be carried over to Form T1161.

You will then be required to complete Form T1161 to indicate any other properties owned by the emigrant, if applicable.