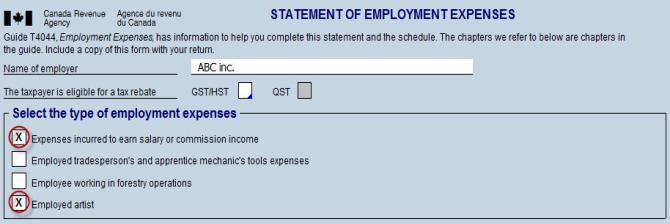

To enter employment expenses, you must first select the applicable type of employment expenses. The sections related to this type of employment expenses will then display.

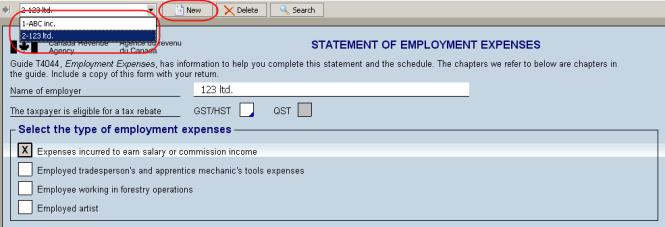

When a taxpayer has more than one employer, two options are available. The first option is to file a single copy of Form T777, in which you report the total employment expenses. Please note that you can select more than one type of employment expense at the top of the form in order to display all of the sections applicable to the taxpayer’s situation.

The second option is to prepare several copies of Form T777, i.e., one per employer. It is possible to create additional copies of Form T777 by clicking the New button located at the top of the form.

Note for Québec residents:

In order to access the various Québec forms with respect to employment

expenses (TP-59, TP-78, TP-75.2 and TP-78.4), you must first select the

type(s) of employment expenses at the top of Form T777.

Note that if you clear the boxes in the “Select the type of employment

expenses” section in Form T777, the corresponding copy of the Québec form

will be deleted including data entered or rolled forward that it contains.

A message will display prompting you to confirm this operation.

When the question The taxpayer is eligible for a tax rebate is answered, the refund of the federal tax on products and services, as well as the refund of the Québec sales tax with respect to expenses incurred, will be automatically calculated. Form GST-370 (federal) or VD-358 (Québec) will then be generated.

However, in certain cases, the taxpayer is eligible for a refund of QST, but not GST. This can be indicated by overriding the “QST” cell.

Expenses provided for under section 8 of the Income Tax Act (ITA) and sections 62 to 80 of the Québec Taxation Act (TA) are the only expenses that may be deducted from employment income. The following paragraphs deal with the most frequently claimed expenses (if the employee is paid in part or entirely by commissions, see the "Commission Salespersons" section below). Employment expenses also include the Goods and Services tax and the provincial sales tax.

An employee may claim legal fees paid to recover (collect) unpaid salary or wages owed by the employer. However an employee cannot claim fees paid to meet his or her obligation to file a tax return (except if his or her job relates to the sale of property or the negotiation of contracts and he or she is entitled to claim expenses under paragraph 8(1)(f) ITA). Thus, the input of legal and accounting expenses has been changed to avoid errors.

Distinction must be made between legal and accounting expenses:

- for recovering a salary or wages or for establishing the right to a salary or wages;

- other.

An employee may claim the amounts spent in the year for travelling in the course of employment if the following conditions are met:

- the employee is ordinarily required to carry on employment duties away from the employer's place of business;

- the employee is required, under the contract of employment, to pay these expenses;

- the employee does not receive a tax-free allowance to cover these expenses;

- the employee does not claim a deduction under paragraph 8(1)(e), (f) or (g) ITA (or their Québec equivalent), as an employee of a railway company, a commission salesperson, or a transport company employee.

Travelling expenses include amounts paid for meals and lodging as well as automobile expenses, including interest paid on money borrowed to acquire an automobile used in the performance of duties and capital cost allowance on that automobile.

Meal expenses

The cost incurred for meals may be deductible by an employee only if the meals are taken during a period where the employee's duties oblige him or her to be away from the municipality or metropolitan region where the employer's place of business is located for more than 12 hours.

Meal expenses may be deducted only up to 50% of the cost incurred.

Québec characteristics

In Québec, an employee who earns commission may deduct meal expenses when he or she is away from the place of business for the duration of the period. After March 13 2008 the twelve hour minimum is not applicable.

Automobile expenses

The following automobile expenses are deductible based on the kilometres travelled in the year for employment purposes:

- gas and oil;

- maintenance and repairs;

- insurance premiums;

- car registration and driver's permit

- rental fees (taking into account the limit below).

Leasing costs

With respect to the rental of a passenger vehicle, the maximum eligible fees, before the calculation of the portion for employment expenses, is equal to the lesser of:

- the lease charges;

- the amount of $800 plus taxes per month; and

- the product of $30,000 plus taxes over the greater of $35,295 ($30,000/85) plus taxes and the manufacturer's suggested retail price multiplied by 85% and the lease charges.

History based on the year of acquisition or the beginning of the lease:

|

|

Capital cost |

Monthly leasing fees |

|---|---|---|

|

|

|

|

|

2001 and following |

$30,000 |

$800 |

|

2000 |

$27,000 |

$700 |

|

1998 and 1999 |

$26,000 |

$650 |

|

1997 |

$25,000 |

$550 |

|

1991 to 1996 inclusively |

$24,000 |

$650 |

Parking

Parking fees incurred elsewhere than the usual place of employment and for the purpose of earning business income are fully deductible.

Repayments and allowances

Refunds of automobile expenses by an employer and reasonable allowances based exclusively on the distance travelled for employment purposes are excluded from the employee's income. However, any allowance that is considered not reasonable must be included in the employee's income. Moreover, the portion of allowances paid that exceed 55 cents per kilometre for the first 5,000 kilometres and 49 cents per kilometre for additional kilometres is not deductible by the employer. For the Northwest Territories, Yukon and Nunavut, the tax-exempt allowance is 59 cents for the first 5,000 kilometres driven and 53 cents for each additional kilometre.

Other deductible travelling expenses (par. 8(1)(j) ITA, s. 64 TA)

In addition to the automobile expenses deductible under paragraphs 8(1)(h) and (h.1) ITA (or their Québec equivalent), an employee may claim capital cost allowance and the interest on a loan for the acquisition of a vehicle, based on the kilometres travelled for employment purposes.

Capital cost allowance

The calculation of capital cost allowance must be made taking into account the rules with respect to "passenger vehicles," which are:

- Passenger vehicles costing $30,000 or less (before taxes) are part of class 10.

- Passenger vehicles costing more than $30,000 (before taxes) are part of class 10.1.

- Only the first $30,000 may be subject to capital cost allowance. Unrecovered federal and provincial taxes are added to this amount.

- A separate class 10.1 must be created for each eligible vehicle. Each new acquisition is subject to the half-year rule.

- No recapture or terminal loss may result from the disposition of a vehicle included in class 10.1. However, in the year of disposition of the vehicle, a capital cost allowance representing half the deduction normally claimed is granted.

- No terminal loss can result from the disposition of a vehicle included in class 10. However, if the disposition generates a recapture, the amount of this recapture must be included in income.

- No capital cost allowance is permitted when a class 10.1 vehicle has been acquired and disposed of in the same year.

Interest

The following are the dates and the maximum applicable amounts based on the year assumed by the program:

- Acquisition of vehicles:

- 2001 $10.00

- 1997 to 2000 $8.33

An employee may deduct the following contributions if they have not been reimbursed and the employee is not entitled to a reimbursement:

- annual professional membership dues the payment of which is necessary to maintain a professional status recognized by statute;

- annual dues to a trade union;

- annual dues to a parity or advisory committee or similar body, the payment of which was required under the laws of a province.

The contribution is not, however, deductible if it is paid for one of the following purposes:

- superannuation fund or plan;

- insurance plan (other than mandatory liability insurance to maintain a professional status recognized by law);

- any other purpose not directly related to ordinary operating costs of the organization to which the contribution was paid.

Rules specific to Québec

Professional and union dues paid by an employee provide entitlement to a 10% tax credit. The amount eligible for the credit excludes GST and QST, but these taxes may be refunded, if certain conditions are met. The refund will not have to be included in the following year's income.

A self-employed worker may also claim the tax credit with respect to annual dues paid to a professional organization to maintain a professional status recognized by law. The eligible amount includes the GST and QST. However, if the taxpayer is reimbursed for these taxes, the amount of the refund will have to be included in the following year's income.

Rent, salary or wages and supplies (par. 8(1)(i) and (l.1) and ss. 8(13) ITA, s. 78 TA)

An employee may claim the following expenses when the contract of employment provides that he must pay them:

- office rent;

- supplies used directly in the employment duties;

- the salary or wages of an assistant or substitute.

However, the following expenses, among others, are not deductible:

- the cost of tools considered as equipment;

- the acquisition or rental cost of a computer;

- the cost of special clothing

Apprentice vehicle mechanics’ tools deduction (par. 8(1)(r))

For 2002 and following years, an employee may deduct from his or her employment income as an apprentice mechanic registered with a provincial or territorial body in a program leading to designation as a mechanic licensed to repair automobiles, aircraft, or any other self-propelled motorized vehicles the "deductible cost of the tools."

Summarily, the "deductible cost of tools" corresponds to the total cost of the tools and ancillary material less the greater of $1,195 and 5% of the apprenticeship income for the year.

Home office (ss. 8(13) ITA and s. 62.1-62.3 TA)

An employee who uses a home office may claim the rent as well as the electrical, heating, and maintenance costs in proportion to the space occupied for employment purposes. He may not deduct property taxes, home insurance premiums and mortgage interests and cannot claim capital cost allowance.

Eligible expenses are only deductible if one of the following conditions is met:

- the home office is the place where the employee principally performs his or her employment duties;

- the home office is exclusively used to earn employment income and is used to meet clients or other persons on a regular and continuous basis in the normal course of his or her duties.

The deduction of home office expenses cannot exceed the employment income earned in the year. However, expenses not deducted in a year because of this limit may be claimed in following years.

Rules specific to Québec

The 50% limit applicable to the home office expenses of a self-employed worker do not apply to an employee, whether paid a salary or on commission.

Under paragraph 8(1)(f) ITA and section 62 TA, an employee who performs duties related to the sale of property or contract negotiations may deduct expenses incurred in the year to earn employment income if the following conditions are met:

- the employee has to pay for these expenses;

- the employee usually carries out his or her employment duties away from his employer's place of business;

- the employee is paid entirely or in part by commissions;

- the employee does not receive a tax-free travelling allowance for his or her expenses;

- Form T2200 (TP-64.3 for Québec purposes) Declaration of Conditions of Employment is completed and kept on file;

Deductible expenses

Commission salespersons are entitled to deduct not only the same expenses as salaried employees (see above) but also the following expenses, among others:

- advertising and promotion expenses;

- entertainment expenses;

- liability insurance premiums;

- permits and licences;

- training expenses;

- equipment leasing expenses (see below);

- professional fees paid to respect the obligation to file a tax return.

Leasing of equipment

Expenses related to the leasing of a computer, photocopy machine, telephone or any other similar piece of equipment are deductible if they were used to earn commission income. However, when such equipment is purchased rather than leased, deductions for capital cost allowance or interest paid are not allowed.

Specific limit with respect to entertainment expenses

Note that a 50% limit applies to all business meals, food and beverages included, as well as to the cost of meals while the taxpayer is travelling or attends a conference, seminar or other similar event. This limit also applies to tickets paid for a show or sporting event, to tips and cover charges, to rooms rented for entertainment purposes and to the cost of private boxes in sporting facilities. When a taxpayer is reimbursed entertainment expenses or business meals, the 50% limit applies to the person making the refund.

Rules specific to Québec

Some expenses are not subject to the 50% limit. These are expenses related to the cost of subscription to symphony orchestra concerts, jazz or classical music ensemble concerts, opera performances, dance and theatre performances, provided these cultural events take place in Québec. For this purpose, a subscription must include at least three representations in eligible disciplines. In addition, certain vocal performances as well as the purchase of tickets representing all or almost all of the tickets of a representation in an eligible discipline will no longer be subject to the 50% rule.

Home office

With respect to a home office, a commission salesperson may deduct the same expenses as a salaried employee under the same conditions. This person may also claim the premiums paid under a home insurance policy as well as property taxes.

Mortgage interest, however, is not deductible and the commission salesperson cannot take advantage of capital cost allowance.

Limit to the deduction

Expenses deductible under paragraph 8(1)(f) ITA including home office expenses, are limited to the total of amounts received by the employee in the year as commissions. However, the interest and the capital cost allowance deductions allowed under paragraph 8(1)(j) ITA are not subject to this limit while home office expenses are limited to employment income.

Rules specific to Québec

Insurance premiums and property taxes included in home expenses are subject to the commission income limit.

Election possible for commission salespersons

If expenses are greater than commission income, the employee may elect to deduct expenses as if he or she was not a commission salesperson. Consequently, the employee may not deduct certain types of expenses, but the expenses deducted will not be limited to commission income.

Employees working in forestry operations may claim the costs related to the use of a power saw if the employment contract requires the use of a power saw and the employer does not reimburse the costs thereof. In addition, the following two conditions must be met:

- The taxpayer worked in forestry operations;

- The power saw is used to earn employment income.

The purchase price of the power saw may be claimed in the year of purchase. However, any trade-in value or any amount received from the sale of a power saw in the year must be deducted from the purchase price of the new saw.

When the taxpayer's return is filed, attach a detailed list of the costs related to the use of the saw. You must also complete Form T2200, Declaration of Work Conditions. The fees related to the use of the power saw include the GST and the PST or HST that was paid.

You cannot claim travelling expenses paid to get from the taxpayer's home to the cutting site, from the taxpayer's home to the logging camp, or from the logging camp to the cutting site. Such costs are considered to be personal or living expenses. Also, the cost of horses and harnesses, snowmobiles and all terrain vehicles is not deductible, since these costs represent capital expenditures. In addition, you cannot claim interest on loans to acquire the above-mentioned property, or claim capital cost allowance in their respect.

An artist may claim the lesser of:

Expenses actually paid in the current year; and

The lesser of:

- $1,000; and

- 20% of employment income earned from artistic endeavours,

Minus: the costs related to a musical instrument, interest on a motor vehicle and the CCA on a motor vehicle that have been claimed against employment income earned from an artistic endeavour.

Expenses related to a musical instrument

As a salaried musician, the employer may require that the artist supply his or her own musical instrument. In this case, you may claim the expenses related to the musical instrument that the artist incurred. The expenses related to the musical instrument include the GST and the PST or the HST paid for these expenses.

The following expenses may be claimed for the musical instrument:

- maintenance fees;

- rental fees;

- insurance fees;

- capital cost allowance (if the instrument belongs to the taxpayer).

However, the amount claimed cannot exceed the income for the year from employment as a musician determined once all other employment expenses, other than expenses related to a musical instrument, have been claimed.

A terminal loss cannot be sustained from the disposition of a musical instrument. However, if the disposition generates recapture of CCA, this recapture must be included in income.

See Also