Fill out and attach a copy of this form to your tax return if you ceased to be a resident of Canada in the year and you are electing to defer the payment of tax on income relating to the deemed disposition of a property indicated on Form T1243, Deemed Disposition of Property by an Emigrant of Canada. If your election to defer the payment of tax is not for all properties, list the properties for which you would like to defer the payment of tax. You must file this election by April 30 of the year after you emigrate from Canada.

If you make this election and the amount of federal tax owing on income from the deemed disposition of property is more than $16,500 ($13,777.50 for former residents of Quebec), you have to provide us with adequate security to cover the amount. You may also be required to provide security to cover any applicable provincial or territorial tax payable. Contact Canada Revenue Agency (CRA) as soon as possible to make acceptable arrangements before April 30. For more information, go to canada.ca/taxes-international. If applicable, also fill out Form T1161, List of Properties by an Emigrant of Canada.

Notes

If the amount of federal tax on income relating to the deemed disposition of property is $16,500 or less ($13,777.50 or less for former residents of Quebec), security is not required. You must however fill out this form and attach it to your tax return. If your election to defer payment of tax is only for some of the properties you included on Form T1243, Deemed Disposition of Property by an Emigrant of Canada, complete the chart “Details of property to which this election applies” to list the properties for which you would like to defer the payment of tax.

If you resided in Quebec prior to ceasing Canadian residency, do not fill out lines 10 to 12 of this form.

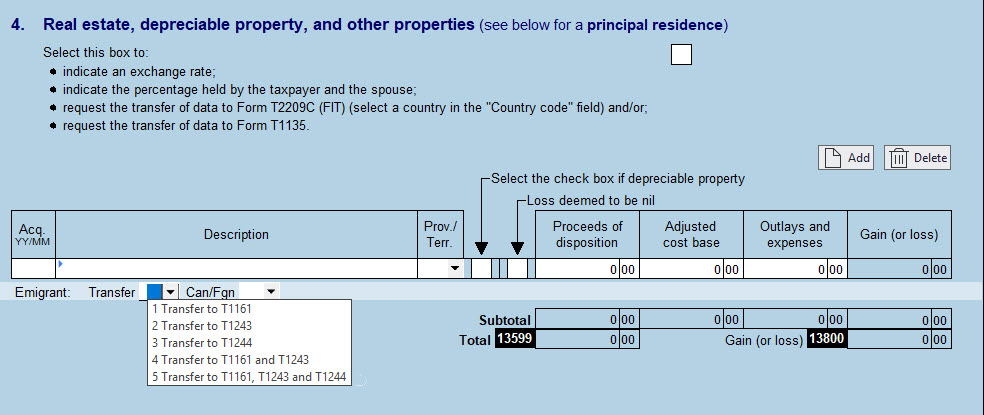

When you complete Schedule 3, Summary of Dispositions – Capital Gains (or Losses) to determine the capital gains (or loss) incurred by the taxpayer due to real or deemed dispositions, be sure to select T1244 or T1161, T1243 and T1244, if applicable, from the drop-down list of the Transfer column. Similarly, select (C) or (F) from the drop-down list of the Can/Fgn column to indicate whether it is Canadian or foreign property.

The Transfer and Can/Fgn columns for emigrants become available in Schedule 3 as soon as you indicate a date of departure in the “Residence” section of the Identification form for this taxpayer.