Fill out Form T1206 if any of the following applies:

- you are a specified individual, have split income in the tax year, and the income is not an excluded amount

- you claimed a reserve on line C of your 2018 Form T1206

You are a specified individual if you were a resident of Canada at the end of the tax year, or in the case of a deceased individual, the individual was a resident of Canada immediately before their death. If you were under 18 years of age at the end of the year, at least one of your parents must have also been a resident of Canada at any time in the year. For excluded amounts and definitions, see below.

Split income

Split income includes the following amounts:

- taxable dividends on shares of a corporation (other than shares of a class listed on a designated stock exchange and those of a mutual fund corporation), that you received directly or through a partnership or a trust (other than a mutual fund trust)

- shareholder benefits from the ownership of shares of a corporation (other than shares of a class listed on a designated stock exchange), conferred on you directly, or through a partnership or a trust (other than a mutual fund trust)

If you were under 18 years of age at the end of the year and you realized a taxable capital gain (other than an excluded amount), or received a distribution from a trust that is from a taxable capital gain (other than an excluded amount) of the trust, from a disposition of certain shares directly or indirectly to a person with whom you do not deal at arm's length, then twice the amount will be deemed to be a taxable dividend. Deemed dividends of this kind are considered non-eligible dividends. If this applies to you, fill out the "Dispositions of certain capital property" section of this form.

- income you received from a partnership or a trust (other than a mutual fund trust or a trust relating to a communal organization), if the amount is considered to come directly or indirectly from one of the following:

- a related business (see the Definitions section)

- from the rental of property by a particular partnership or trust, if a person who is related to you at any time in the tax year:

- actively participates on a regular basis in the rental property activities of the particular partnership or trust

- in the case of a particular partnership, has an interest in the partnership, directly or indirectly, through one or more other partnerships

- income related to a debt obligation (for example interest) that you received from a debtor corporation (other than a mutual fund corporation or a corporation with shares of a class listed on a designated stock exchange), partnership or trust (other than a mutual fund trust), if other amounts (for example dividends) that you received from the debtor would be subject to the tax on split-income (TOSI) rules

However, do not include the amounts received from any of the following debt obligations (an excluded debt obligation):

- certain government debt obligations, where the interest would be "fully exempt interest"

- publicly-listed or traded debt

- a deposit standing to your credit at a bank or credit union

- a taxable capital gain or a profit you realized from the disposition of a property, or income you received from a trust that is from a taxable capital gain or a profit of the trust from the disposition of property, if the following conditions are met:

- the amount is not otherwise included in the definition of split income

- the income from the property would also be split income if you received it

This applies to a disposition occurring in 2019 and later years for any of the following properties:

- a share of a corporation (other than a share of a class listed on a designated stock exchange or a share of a mutual fund corporation)

- an interest in a partnership or as a beneficiary under a trust (other than a mutual fund trust or a trust that relates to certain communal organizations)

- a debt obligation (other than an excluded debt obligation as described above)

For property listed above other than shares of a corporation, this rule will only apply if one of the following conditions applies to the property:

- an amount was included in your split income for this year or a previous year

- all or part of the fair market value (FMV) of the property immediately before its disposition was derived from a share of a corporation (other than a share of a class listed on a designated stock exchange or a share of a mutual fund corporation)

Excluded amounts

The following amounts will be excluded from your split income:

- income from a property that was transferred to you because of a separation agreement or judgment resulting from the breakdown of your marriage or common-law partnership

- taxable capital gains that arose from any of the following:

- you disposed of qualified farm or fishing property or qualified small business corporation shares, or a taxable capital gain from such property that was realized by a trust was allocated to you as a beneficiary of the trust. This exclusion does notapply to capital gains that are deemed to be taxable dividends.

- there was a deemed disposition of capital property on the death of the taxpayer

- you were at least 18 years of age at the end of the year and the amount you received is any of the following:

- not derived, directly or indirectly, from a related business

- derived, directly or indirectly, from an excluded business

- you were between 18 and 24 years of age at the end of the year, and the amount you received is any of the following:

- your safe harbour capital return for the year

- an amount that represents a reasonable return in respect of your arm's length capital contributions

- you were under 25 years of age at the end of the year and your income, or your taxable capital gain or profit from the disposition of property, was from a property you inherited from one of the following:

- your parent

- anyone else if, during the year, you were enrolled full-time in a post-secondary institution or you were eligible for the disability tax credit

- you were at least 25 years of age at the end of the year, and you received any of the following:

- income or taxable capital gain from the disposition of excluded shares

- an amount that represents a reasonable return from a related business

- income, or taxable capital gain or profit from the disposition of property, if the amount would be an excluded amount of your spouse or common-law partner in one of the following situations:

- if the amount was included in calculating the income of your spouse or common-law partner who was at least 65 years of age at the end of the year

- if the amount was included in calculating the income in the final return of your spouse or common-law partner who died during the year

For more information, go to canada.ca/cra-income-sprinkling

Definitions

Arm's length capital

Property of the specified individual, where the property, or property for which it is a substitute, was not:

- acquired as income from, or a taxable capital gain or profit from the disposition of, another property that was derived directly or indirectly from a related business in respect of the specified individual

- borrowed by the specified individual under a loan or other debt

- transferred, directly or indirectly, to the specified

Excluded business

An excluded business of a specified individual for a tax year means a business in which the individual is actively engaged on a regular, continuous and substantial basis in the business activities during the year, or in any five previous years (five-year test). However, gains from the disposition of property will be an excluded amount because of the excluded business exception only if the individual satisfies the five-year test.

If the individual works in the business an average 20 hours per week or more during the portion of the year that the business operates, they are considered to have met the excluded business exception in the tax year. A specified individual does not need to work every week that the business operates in a year in order to satisfy the condition for the year. For example, the test would be satisfied if the specified individual works 30 hours per week for 20 weeks for a business that operates 25 weeks per year.

Excluded shares

Excluded shares of a specified individual are shares of the capital stock of a corporation that are owned by the individual if all of the following conditions are met:

- less than 90% of the business income of the corporation, for the corporation's last tax year before that time, is from the provision of services

- the corporation is not a professional corporation that carries on the professional practice of an accountant, dentist, lawyer, medical doctor, veterinarian or chiropractor

- the specified individual owns 10% or more of shares of the capital stock of the corporation, determined by reference to their FMV relative to all of the issued and outstanding shares of the capital stock of the corporation, and to the votes that could be cast at an annual meeting of the shareholders of the corporation

- the income of the corporation for the corporation's last tax year is not derived directly or indirectly from another related business in respect of the specified individual, other than a business of the corporation

Reasonable return

A particular amount derived directly or indirectly from a related business in respect of the specified individual that satisfies both of the following criteria:

- The amount would be an amount defined under "split income", on page 1, in respect of the specified individual for a tax year, if the following excluded amounts are not considered:

- the specified individual was between 18 and 24 years of age at the end of the year, and received an amount that represents a reasonable return in respect of their arm's length capital contributions

- the specified individual was at least 25 years of age at the end of the year, and received an amount that represents a reasonable return from a related business

- The amount is reasonable considering the relative contributions to the related business that were made by the specified individual, and each source individual in respect of the specified individual, having regard to the following factors:

- the work they performed in support of the related business

- the property they contributed, directly or indirectly, in support of the related business

- the risks they assumed in respect of the related business

- the total of all amounts that were paid or that became payable, directly or indirectly, by any person or partnership to, or for the benefit of them, in respect of the related business

Related business

A business will be a related business in respect of a specified individual for a tax year, if a source individual (see definition below) in respect of the specified individual is sufficiently connected to the business at any time in the year. This applies to one or more of the following situations:

- a business that is carried on by a source individual in respect of the specified individual, or by a partnership, corporation or trust, if a source individual in respect of the specified individual is actively engaged in the business

- a business of a particular partnership, if a source individual in respect of the specified individual has an interest, directly or indirectly, in the partnership

- a business of a corporation, if both of the following conditions are met:

- a source individual in respect of the specified individual owns shares of the capital stock of the corporation, or property that derives, directly or indirectly, all or part of its FMV from shares of that capital stock

- the total FMV of the shares and property described above that is owned by the source individual equals at least 10% of the total FMV of all of the issued and outstanding shares of the capital stock of the corporation

Safe harbour capital return

A return up to a prescribed interest rate based upon the FMV of property contributed by the specified individual in support of a related business (pro-rated according to the number of days in the year that the property, or property substituted for it, is used in support of the related business). The highest prescribed interest rate in effect for a quarter in the year is to be used.

Source individual

An individual (other than a trust) who, at any time in a year, is both resident in Canada and related to the specified individual.

TOSI-adjusted net income

Certain federal, provincial, and territorial amounts claimable by you, or by another person in respect of you, are calculated using your net income. As a specified individual, the amount that you include as a deduction at line 23200 of your return in respect of your split income must be added back to your net income for the purpose of calculating these amounts.

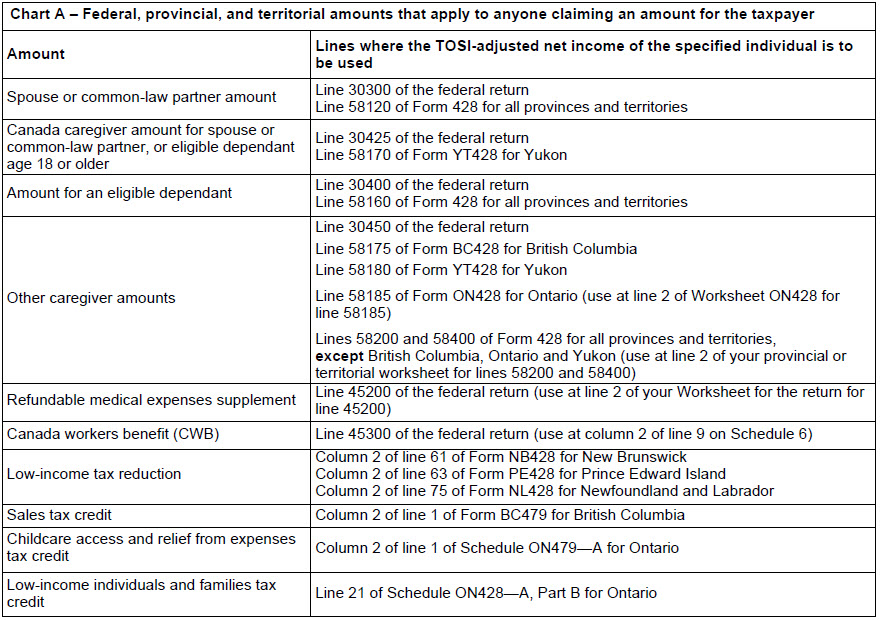

You can calculate your net income as adjusted for the split income deduction in Part 1 of this form. You will use the TOSI-adjusted net income from line 6 to calculate the amounts listed in the note in Part 1. In addition, your TOSI-adjusted net income will be used in place of your net income by a person claiming the amounts shown in Chart A below:

This TOSI-adjusted net income will also be used in the calculation of your or your spouse's or common-law partner's:

|

|

|

|

|

|

|

|

|

|

TOSI-adjusted taxable income

Certain federal, provincial, and territorial amounts claimable by you, or by another person in respect of you, are calculated using your taxable income. As an individual subject to TOSI, the amount that you calculate at line 8A of this form must be added for the purpose of calculating these amounts.

- If you are completing a federal Schedule 11, calculate line 8A and add it to the amount for line 5 of Schedule 11.

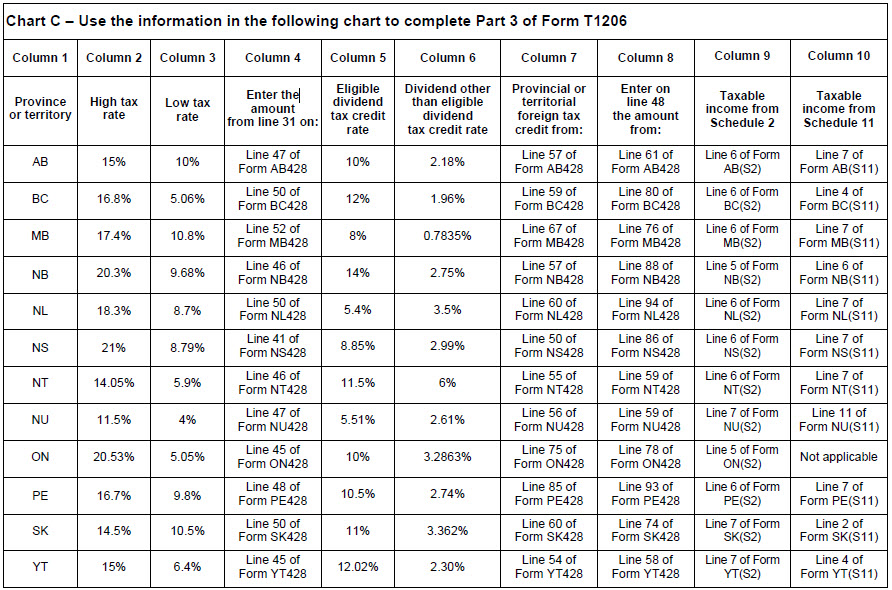

- With the exception of Ontario, if you are completing a provincial or territorial Schedule (S11), add the amount from line 31C of this form to Schedule (S11) at the line outlined in Column 10 of Chart C below, for the applicable province or territory.

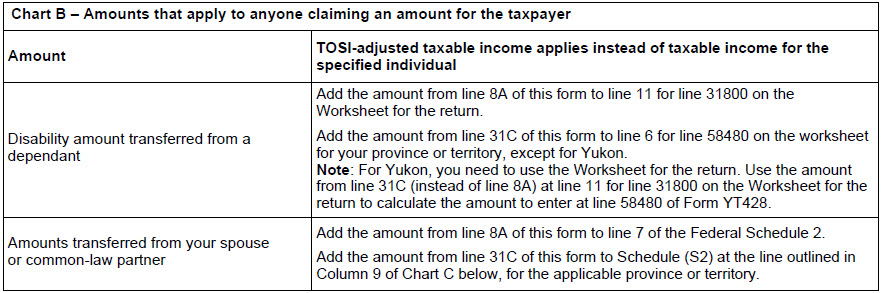

- If you have unused amounts that you are transferring to another person, they will use line 8A and line 31C as directed in Chart B.