The T3 Slips Reconciliation form has been designed to aggregate multiple downloaded T3 slips or RL-16 slips (in general per separate funds) into a single copy in order to reconcile data of the downloaded T3 slips and/or RL 16 slips with the aggregated T3 slips and/or RL-16 slips that have been issued by a securities broker or a pooled investment funds company.

The use of Form T3 Slips Reconciliation is optional and may vary from one return to another. If the taxpayer does not receive any consolidated T3 slips and/or RL-16 slips and/or if the taxpayer does not receive a great number of slips, reconciliation may not be required.

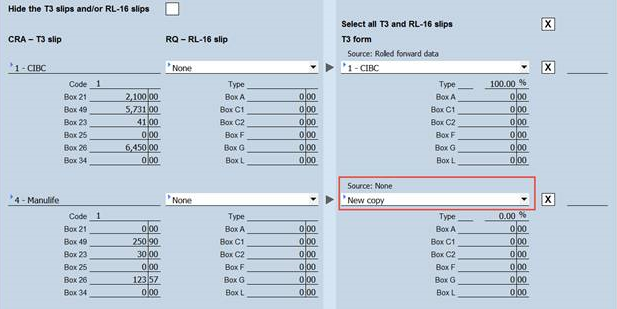

If you want to use Form T3 Slips Reconciliation for a specific return, select the check box at the top of the form. The T3 slips and/or RL-16 slips will then be displayed in this form rather than in Form TaxprepConnect Download. Note that in the TaxprepConnect tab of the preparer profiles, an option allows you to use Form T3 Slips Reconciliation by default.

If you decide to no longer use Form T3 Slips Reconciliation, simply clear the check box at the top of this form, and the downloaded slips will again be displayed in Form TaxprepConnect Download.

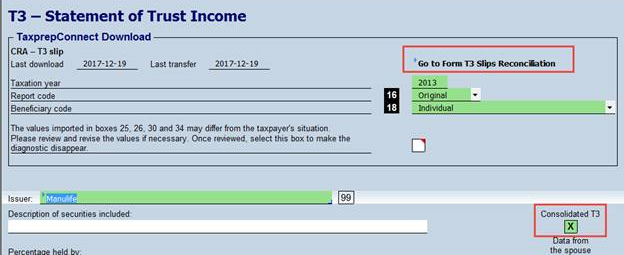

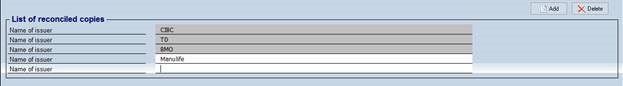

The list of reconciled copies is created from the names of the issuers of copies of Form T3, Statement of Trust Income, already present in the return during the first download of the T3 slips or RL-16 slips as well as from the name of reconciled copies created by the program during automatic association, where applicable. Note that if new copies of Form T3, Statement of Trust Income are created after the list is generated a first time, they will not be added to the list.

However, you can add an issuer’s name in the input fields of the list or override the issuer’s name of a copy already present on the list. Any change made to the T3 issuers’ names or any new issuer’s name entered will display in Form T3, Statement of Trust Income when the reconciled copies will be eventually transferred to the return.

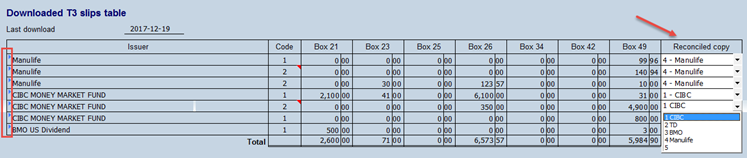

These tables aggregate all of the downloaded T3 slips and/or RL-16 slips and show the principal boxes that can help reconciliation. The details of the downloaded T3 slips and/or RL-16 slips are however available from expands depicted by a blue arrow to the left of the slip/RL slip issuer’s name.

In the Reconciled copy column, if the client file has been rolled forward and reconciled copies have been created in the previous year, a preselection is automatically made by Personal Taxprep to associate the reconciled previous-year copy with the T3 slips and/or RL-16 slips based on data displayed in the tables of the previous-year reconciled copies. However, ensure that the T3 slips and/or the RL-16 slips have been aggregated correctly and that each slip has been assigned to a reconciled copy. If you want to modify the preselection made by the program, select the appropriate reconciled copy in the list, using an override.

If the client file has not been rolled forward or if there were no reconciliations made in Form T3 Slips Reconciliation in the previous year, select the appropriate reconciled copy for each downloaded slip/RL-slip. If you select the same copy for both the T3 slips and RL-16 slips, the program will automatically match them once they are transferred to the TaxprepConnect Download form.

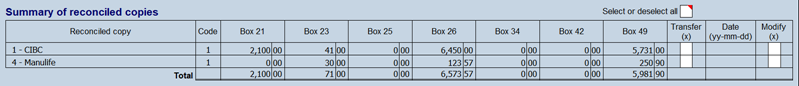

The “Summary of reconciled copies” section displays each reconciled copy and is updated automatically as soon as a reconciled copy is selected in the downloaded T3 slips and/or RL-16 slips tables. The totals for the principal boxes are displayed to help you compare the reconciled copies with the aggregated T3 slips and/or RL-16 slips issued by a securities broker or a pooled investment funds company.

In addition, to make sure that all downloaded T3 slips and/or RL-16 slips have been assigned to a reconciled copy, you can compare the amounts of the Total line in this table with the amounts on the Total line in the table of the downloaded T3 slips and/or RL-16 slips.

These tables are for information purposes only and display all T3 slips and/or RL-16 slips downloaded in the previous year and that have been aggregated in a reconciled copy, as well as the name of that copy. Data in these tables are used by the program to perform an automatic association of the T3 slips and/or RL-16 slips downloaded this year, by comparing them to the previous year slips and RL slips, to associate the same reconciled copy. However, you can refer to it to verify that the reconciliations performed this year correspond to those performed last year, where applicable.

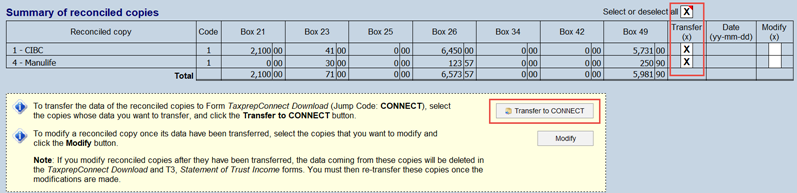

When all T3 slips and/or RL-16 slips have been downloaded and reconciled, you can, if you want, transfer the reconciled copies to Form TaxprepConnect Download (Jump Code: CONNECT) then, from there, transfer them to the return.

To transfer data from all reconciled copies, select the check box Select or deselect all to select all copies and then click the Transfer to CONNECT button. If you want to transfer data from only one reconciled copy, select the check box of the desired copy in the Transfer column, and click the Transfer to CONNECT button.

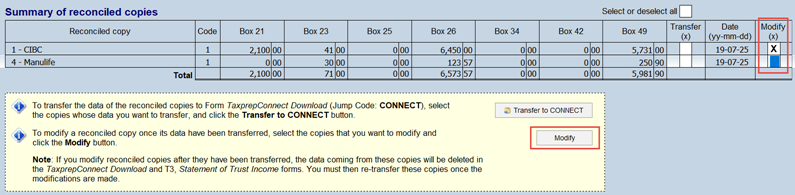

If you want to modify the content of a reconciled copy that has already been transferred to the TaxprepConnect Download form, select the check box of the copy to modify in the Modify column, then click the Modify button.

Once data in the reconciled copies is transferred, it will display in Form TaxprepConnect Download and will be automatically selected for transfer to Form T3, Statement of Trust Income, unless a different option has been defined in the TaxprepConnect tab of the preparer profile you are using.

If you associated T3 slips and/or RL-16 slips with a reconciled copy present already in the return, it will automatically be selected. If, on the other hand, you created a new copy by adding a name in the list of reconciled copies, a new copy of Form T3, Statement of Trust Income will be assigned to this reconciled copy.