For more information, consult section "Form T183, Information Return for Electronic Filing" in Guide RC4018, Preparing Electronic Records.

Pre-authorized debit (PAD) agreement

Form T183 is used both to authorize the electronic transmission of a T1 return and a pre-authorized debit agreement.

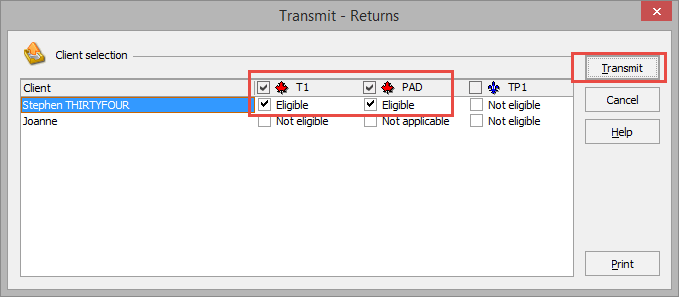

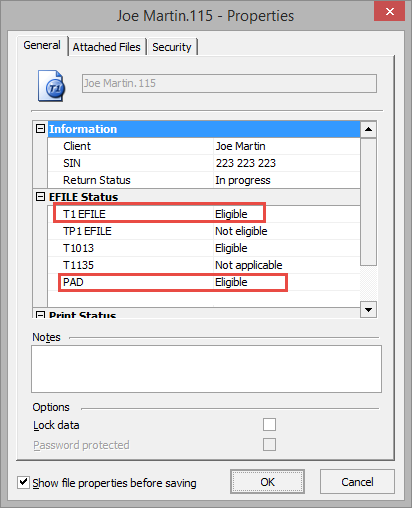

It is important to understand that the T1 return and the PAD agreement are subject to separate background transmissions. This is why there is an “EFILE T1” status as well as a “PAD” status.

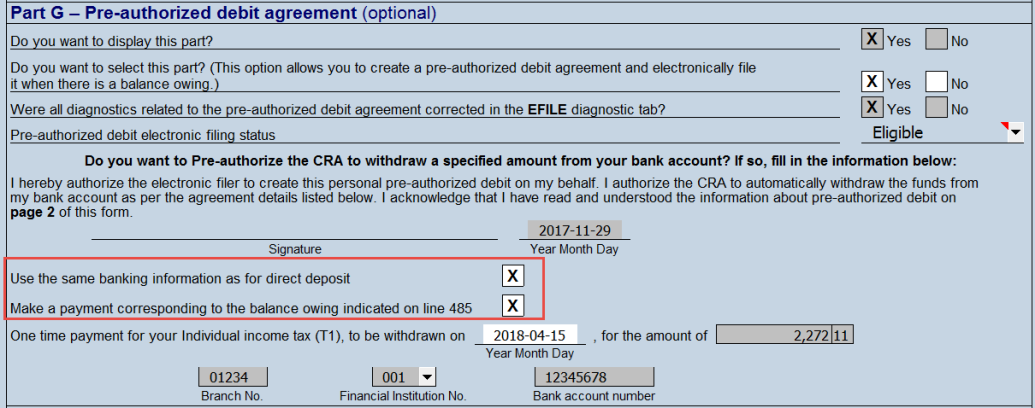

In order to be able to transmit a PAD agreement electronically, you must first ensure that you answer “Yes” to the question “Do you want to select this part?” on Form T183, otherwise, the value of the PAD status will be “Not applicable.”

Two options are available to help you maximize your productivity and limit the risk of errors.

- If the Taxprep client file contains banking information for direct deposit on Form Direct Deposit Request (Jump Code: DD), you can transfer this information in the section of Form T183 relating to pre-authorized debit.

- You can also indicate that the taxpayer wants to make a payment corresponding to the balance owing indicated on line 48500 of the T1 return.

To make these choices, simply select the following boxes:

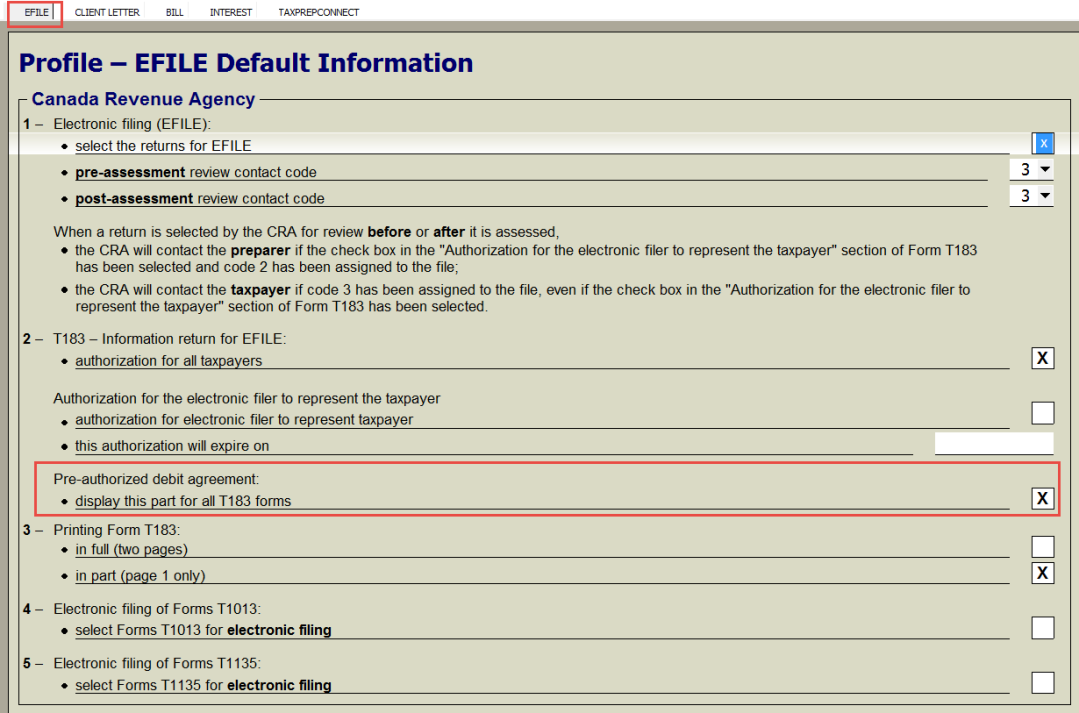

Note that, by default, the PAD agreement part displays automatically. However, you can hide it in a particular client file by using an override to answer “No” to the question “Do you want to display this part?” in Form T183.

You can also hide this part for all your client files by clearing the box display this part for all T183 forms in the section Pre-authorized debit agreement in the EFILE tab of the preparer profile you are using.

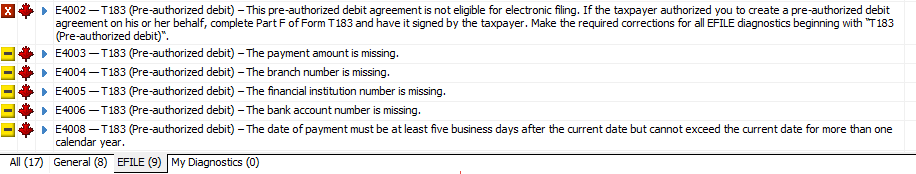

Once the PAD section of Form T183 is selected, you have to make sure that you made the required corrections for all EFILE diagnostics of the E4000 series so that the value of the PAD status becomes “Eligible,” otherwise you will not be able to transmit the PAD agreement or the T1 return.

In order for you to transmit a T1 return, the “Eligible” or “Not applicable” value must be defined for the PAD status.

However, it is not necessary for the T1 return status to be “Eligible” to be able to transmit a PAD agreement.

PADs with an “Eligible” status are shown in the PAD column at the time of transmission. This way, you can choose to transmit the PAD agreement at the same time as the T1 return, or choose to transmit them separately.