|

Notice: The information on this page is only for users of Personal Taxprep 2018. If you are using Personal Taxprep Classic 2018, consult the help available in the program. |

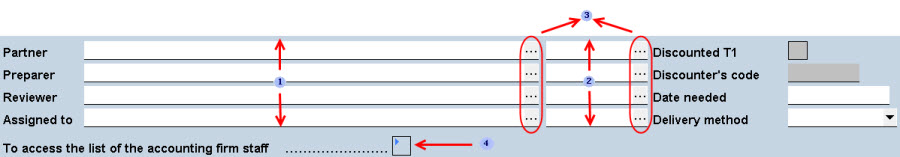

The fields “Tax Preparer’s Profile used,” “Personalized identification number,” “Client code,” “Partner,” “Discounted T1,” “Preparer,” “Discounter’s code,” “Reviewer,” “Date needed,” “Assigned to” and “Delivery method,” at the top of the form, are only provided to help you manage tax returns. This is not information required on the paper return or information that will be transmitted with EFILE. Note that the name in the “Partner” field is kept at all times when rolling forward data. However, the names in the “Preparer,” “Reviewer” and “Assigned to” fields will not be kept if the check boxes Keep the reviewer’s name, Keep the preparer’s name and Keep the field “Assigned to” have been cleared under Roll Forward/Data Options in the Options and Settings dialog box.

If you are using the staff list from the preparer profile, note that the names will be rolled forward when the preparer profile is converted and this preparer profile must be rolled forward first in order for the names to be rolled forward as well in the client file.

Using a Preparer Profile

You may now create a list of the accounting firm staff to make it easier to manage the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields.

|

|

The names of the staff members selected for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

|

The identification numbers of the staff members for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

|

Click these buttons to access the list of names or identification numbers of staff members who are assigned the roles of “Partner,” “Preparer” and “Reviewer,” as well as the general list accessible using the “Assigned to” field in the preparer profile used and in the customized list described at point four. You may create separate lists for each of the three roles. As for the list of the “Assigned to” field, it contains the first and last names of all persons in the list of the accounting firm staff in the preparer profile and in the customizable list described at point four. |

|

|

Double-clicking this expand box will allow you to access the List of the Accounting Firm Staff form. The names of the accounting firm staff entered in the list in the preparer profile will be displayed, but cannot be modified. However, if the check box Allow customizing the list using Form Identification and Other Client Information has been selected in the preparer profile used, you may add names to the list. Note that the names of staff members added in that section are only accessible in the active client file and are not added to the master list in the preparer profile. If you entered the names of staff members in the input section of the List of the Accounting Firm Staff form, but you do not want to roll them forward, clear the Retain these values when rolling forward the file check box at the bottom of the form. |

Note: Using the list of the accounting firm staff in this section of the form will not be possible if no preparer profile has been converted or created.

Using the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields in the client filters

Form File Identifier Worksheet (Jump Code: FILE) includes fields that can be used to create customized filters. These fields contain values from the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields, whether you are using the list of staff members or the input fields.

Following roll forward of the client file, the fields in the File Identifier Worksheet will display the rolled forward data in the ID form as long as this data is not modified.

See Also

Personal Taxprep allows you to link a tax return to a CCH iFirm contact, our office management program time and billing.

The "CCH iFirm" section displays the additional information from the linked CCH iFirm contact. The "Client code" field allows you to input the client code allocated to the taxpayer and is used to search for corresponding contacts and for creating contacts in CCH iFirm. However, you can configure another field for searching and for creating contacts to use when the field "Client code" does not contain any value. To do so, consult the "CCH iFirm – General" topic.

The "Partner" field displays the name of the partner in your firm who has been assigned to the taxpayer, while the "Salutation" field indicates the name used for the correspondence in CCH iFirm. The content of these fields is synchronized between Taxprep and CCH iFirm, while the content of the "Partner" field is updated based on the CCH iFirm contact information.

You must enter the title (Mr., Mrs. or Ms.) that will be printed on the client letter as well as on page 1 of the tax return. The title indicated in this section identifies the sex of the taxpayer.

When the taxpayer's income tax return is prepared as same-sex partners, please select the Same-sex partners check box in order for the program to determine the appropriate title (Mr., Mrs. or Ms.).

The date of birth must be specified or else the program assumes that the taxpayer is 40 years old.

The social insurance number refers to the social insurance number (SIN), the temporary tax number (TTN) or the individual tax number (ITN).

When you prepare the tax return of a deceased taxpayer, you do not have to enter "Estate" in the title field, nor after the name of the deceased person. The program automatically prints the word "Estate" on page 1 of the federal return and the name of the deceased person on page 1 of the Québec return.

To claim the spouse or common-law partner amount, select the Supported his spouse (if death in the year) check box only if the surviving spouse supported the deceased spouse before his death.

The CPP calculations are automatically adjusted when a date of death is entered. However, non-refundable tax credits are not prorated because the program assumes that these credits will not be claimed again in a return of rights or things.

The Form Income Tax Returns for Deceased Persons (Jump Code: DECEASED) allows you to file different types of returns for a deceased person. In addition, the program does not specifically calculate a return of rights or things. If you prepare such a return, you must, if applicable, override the prorated non-refundable tax credit amounts and select the Return for income from rights or things – 70(2) check box.

Diagnostics advise you of the modifications made to some calculations (repayment of social transfers, medical expenses credits, etc.). In addition, the program deducts the maximum net capital losses carried forward from all other income.

You must specify in this section if the taxpayer is entitled to the disability amount and, if applicable, if this a first-time claim in order for the program to claim this credit.

Indicate the last year of eligibility if the disability tax credit has been granted for a limited period. This information will enable diagnostics prompting you when the last year of eligibility is reached or when the eligibility period is expired. It will also allow the program to include a paragraph in the client letter in order to advise your clients who are claiming this credit to have a new copy of Form T2201 completed by a qualified practitioner to renew their eligibility for this credit.

You can also enter this information for Form TP-752.0.14 for purposes of the Québec return in the “Other information regarding provincial or territorial credits” section.

Please pay special attention to the marital status entered for the taxpayer and the spouse to ensure that it reflects the couple's situation correctly.

Spouse: A spouse is a person with whom the taxpayer was legally married.

Common-law partner: A common-law partner is a person, who is not the taxpayer's spouse, who lives with the taxpayer in a spousal relationship and who meets one of the conditions below:

- was the biological or adoptive parent of the taxpayers child (and vice versa);

- had been living in this relationship with the taxpayer for at least twelve consecutive months (the twelve-month period is considered to have been uninterrupted if the persons lived apart for less than 90 days);

- had custody, supervision and full responsibility for the taxpayer's child (or had custody and supervision just before the child turned 19).

Situation on December 31

Note that for Québec tax return purposes, the term "with spouse" is used to designate a person with whom the taxpayer is married as well as a person who was his or her common-law partner at some time in the current taxation year or the person with whom the taxpayer was in a civil marriage.

By default, the program assumes that the taxpayer is a single person. To enter data with respect to two persons where information pertaining to one has an impact on the income tax return of the other, you must prepare the two returns together.

Married persons (code 1)

The program automatically computes the spousal amount to be transferred between spouses within the limits prescribed by the Act. You must consider the taxpayer as a "spouse" on December 31 of the current taxation year if the taxpayer was separated for less than 90 days as a result of a breakdown of the relationship.

At the federal level, the program considers each person to be a "supporting person" in computing the child care expense deduction and to be a "spouse or common-law partner " for the purposes of the Canada Child Benefit, the Universal Child Care Benefit, the federal goods and services tax credit and the Working Income Tax Benefit. By default, the program calculates the Canada Child Benefit in the return of the "female" spouse. However, in the case of same-sex partners, the benefit is calculated in the return of the principal taxpayer.

For Québec residents, the program considers each of these persons to be the "spouses" for purposes of the real estate tax rebate, the refundable tax credit for child care expenses and the refundable and non-refundable medical expenses tax credits.

Widow(er) (code 2)

When there is a spouse or common-law partner, if there is a date of death for one of the taxpayers and the returns are prepared together, the program indicates that the surviving spouse or common-law partner is married. However, a diagnostic will prompt you to change the marital status of the surviving spouse.

Divorced (code 3) or separated (code 4)

You can simultaneously prepare the income tax returns of two spouses who have separated or divorced during the year. In such cases, the divorce or separation date is to be entered in the "Change of marital status". The program indicates that it is a definite break-up.

The program grants the spousal amount to the eligible spouse based on the limits prescribed by the Act. However, where information with respect to the amount for an eligible dependant is entered in the Family Profile (Jump Code: FAM), the program claims the more advantageous of two amounts, either the spousal amount or the amount for the eligible dependant.

Single (code 5)

By default, the program assumes that the taxpayer is a single person.

The individual must not have a relationship with any other person as defined for tax purposes, as this could affect his or her income tax returns.

When children are identified in the Family Profile (Jump Code: FAM), the program assumes that the taxpayer is the only supporting person for purposes of calculating the child care expense deduction, the Canada Child Benefit, the Universal Child Care Benefit, the Working Income Tax Benefit and the federal goods and services tax credit.

For Québec residents, the program allocates to the taxpayer all of the Solidarity tax credit, the refundable child care expenses credit and the refundable and non-refundable medical expenses tax credits.

Note: A secular priest is deemed to be single.

Common-law partner (code 6)

Common-law partners are treated the same for tax purposes as married couples and may claim such amounts as the spouse or common-law partner amount, the transfer of credits between spouses or common-law partners, the transfer of dividends between spouses or common-law partners, the tax credit with respect to donations and medical expenses paid by the spouse or common-law partner and the amount for eligible dependant, etc.

Coupling

If the marital status is "married" or "common-law", you must select the Taxpayers and spouses returns prepared together check box in order for the returns to be prepared in the same file.

To ensure the accuracy of the results (GST/HST, CCB, Working Income Tax Benefit, child support tax credit, refundable and non-refundable credits for medical expenses), we recommend that you always couple the returns even if you do not file the spouses return. In addition, for purposes of filing the return, you must provide the data with respect to the spouse.

You can access either return by clicking the Switch to Spouse icon or press Alt+F7.

Tip: Keep the Alt key pressed down, then use the F7 key to toggle from one return to another.

You can also prepare the spouses returns jointly when they are separated, were divorced during the year, or one or both of them died. In the case of a separation, you must indicate the date of the change of marital status, if the breakdown is definitive and one of the spouses supported the other before the separation.

In the latter case, you will have to enter the spouse's net income before the separation in the "Spouse's income" section.

The information contained in this section must correspond to the information entered on the CRAs personalized labels, as the latter may have modified the format of the individuals address to comply with postal requirements.

You must select the province contained in the address using a predefined list. Only the provinces shown in this list may be printed. The program also determines if the postal code entered is valid using a diagnostic.

In addition, for an individual living in the United States, you must select the state contained in the address using the predefined list and enter the zip code in the appropriate fields in order for the CRAs print conditions to be complied with. For all other cases, enter the foreign address in the city field and select the appropriate country.

For the Québec tax return, the out of the country address is printed on page 1 of the Québec tax return, on the TPF-1.W-V summary and on the Québec Income Tax Return Outline.

TP1 return – Change in the mailing address of the taxpayer

An answer to the question Has the taxpayer’s mailing address changed from the previous taxation year? is required for transmission of the TP1 return. This information will allow Revenu Québec to update the taxpayer’s address in their files, if applicable.

If you roll forward a client file and that, thereafter, you leave the rolled forward data as is for the mailing address, the answer to this question will be “No.” However, if you modify one or more elements of the rolled forward address, the answer to this question will become “Yes.”

Connected T1 return of a dependant

If the check box Use the taxpayer’s mailing address is selected in the connected return of a dependant and you modify the taxpayer’s mailing address, the mailing address entered the ID form of that dependant will be automatically modified to reflect the change made. If the dependant’s address differs from that of the taxpayer, you only need to enter the dependant’s address in the ID form of this dependant, and the check box Use the taxpayer’s mailing address will be automatically cleared.

See Also

The information in this section will be used when printing the different forms, the tax return and the files that have been EFILED. The program assumes that the telephone number to print is that of the residence; if this is not the case, enter the phone number to be used in "Filing information" section.

The boxes The taxpayer has no email address and The taxpayer is registered for the My Account online service are optional and are not used for purposes of the return. However, you can use them in a customized filter to identify your clients who do not have an email address or those who are registered for the My Account online service.

You must complete this section in order to EFILE a T1 return as the information in this section is used to complete Form T183.

Indicate whether the taxpayer is already registered for the CRA’s online mail service, wants to register or is not interested in registering for this service. The e-mail address provided will be transferred to the T1 return and Form T183 for the online mail service registration request.

When a taxpayer is registered for the online mail service, the notices of assessment and reassessment become available electronically in Personal Taxprep via the Express NOA service, if you have a valid T1013 form for online access.

You can ensure that the registration for the online mail service is requested for all your clients by selecting the option for that purpose in the preparer profile you are using.

If the taxpayer does not want to register for the online mail service, you must complete this section in order to EFILE the T1 return as the information in this section is used to complete Form T183.

When the taxpayer does not want to register for online mail, two delivery options are available:

- Paper, i.e. the notice of assessment will be printed by the CRA and mailed through Canada Post;

- Electronic only, i.e. the notice of assessment will be downloaded by the preparer who must provide a copy to the taxpayer.

When a taxpayer does not want to register for online mail and the Electronic only option is selected, the notices of assessment and reassessment will be available electronically in Personal Taxprep via the Express NOA service, if you have a valid T1013 form for online access.

The preparer is then responsible for providing a copy of the notice to the taxpayer because the taxpayer will not receive any e-mail notification from the CRA. The taxpayer understands and agrees that the notice of assessment or reassessment will no longer be printed nor mailed by the CRA.

The province of residence determined by default may be modified in the Preparer Profiles on line 4 of the "Options - Return" section. For users of the T1 version, the province of residence is by default "British Columbia." For users of the TP1 version, the province of residence is by default "Québec."

In addition, for federal tax return purposes, you must also indicate the province of residence of the current address if the latter differs from that entered on the mailing address. This information will enable the program to correctly calculate the benefits and credits that are granted under some provincial or territorial programs to which the taxpayer may be entitled.

For emigrants/immigrants, enter the province of residence at the time of departure from or arrival in Canada. Do not enter the taxpayer as a non-resident. Do not forget to indicate the date of departure.

You must enter the moving date only if the taxpayer moved to another Canadian province. The moving date is required in order for some calculations to be performed correctly when a taxpayer who lived in the province of Québec moved to another Canadian province. The moving date has an impact on the calculation of the instalment payments and the calculation of the Québec health insurance premium.

Indicate whether the mailing address corresponds to the home address by selecting the appropriate box.

The province of residence of the business is the province or territory where the taxpayer was located in the current taxation year. If this is a case of multiple jurisdictions, use the code MJ "multiple." This information is considered for provincial tax payable calculation purposes.

Schedules A, B, C and D – Non-Residents

Non-residents and deemed residents of Canada

Income Taxation pursuant

to sections 216, 217, 115 and 250(1) of the Income Tax Act

The following table consists of a summary of the ways in which the various types of income are taxed according to the applicable section of the Income Tax Act. Refer to this table to know how each type of income is taxed and to properly prepare the return.

In the table, the word "Québec" means that the taxpayer must file both a federal and Québec return. The term "Province" means that the taxpayer must file a federal return including Forms 428 and 479 for the province. The term "48% surtax" means that the taxpayer must only file a federal return in which the 48% surtax is calculated.

|

|

NON-RESIDENT |

DEEMED RESIDENT |

||

|---|---|---|---|---|

|

MAIN |

ELECTION UNDER SECTION 216 |

ELECTION UNDER SECTION 217 |

SECTION 115 |

SECTION 250(1) |

|

Rental |

48% surtax |

N/A |

N/A |

48% surtax |

|

Employment, province other than Québec |

N/A |

Province |

Province |

48% surtax |

|

Employment, Québec |

N/A |

Québec |

Québec |

Québec |

|

Business (active or not), province other than Québec |

N/A |

Province |

Province |

Province |

|

Business, Québec |

N/A |

Québec |

Québec |

Québec |

|

Capital gain on taxable Canadian property |

N/A |

48% surtax |

48% surtax |

48% surtax |

|

Capital gain on taxable Québec property |

N/A |

Québec |

Québec |

Québec |

|

Scholarships and net research grants, province other than Québec |

N/A |

48% surtax |

48% surtax |

48% surtax |

|

Scholarships and net research grants, Québec |

N/A |

Québec |

Québec |

Québec |

|

Pension benefits (see detailed list under the section 217 election section) |

N/A |

48% surtax |

N/A |

48% surtax |

Return According to Section 216 – Election Rental Income and Timber Royalties

The deadline to file the income tax return is:

- If Form NR6 has not been filed: December 31, 2020.

- If Form NR6 has been filed: June 30, 2019. However, the balance will be due on April 30, 2019.

- If there has been recapture: April 30, 2019;

- if there was disposition of a leasing property in 2018 for which the taxpayer claimed a capital cost allowance in a prior year, on April 30, 2019.

The program taxes this income taking into account the 48% non-resident surtax and no personal tax credits are granted.

The taxpayer is entitled to the child support deduction as well as to a deduction for RRSP contributions made in Canada.

If rental income is deposited in a bank account and the taxpayer earns interest on this income, the financial institution must be advised to make non-resident tax withholdings on the interest income (Part XIII tax). This tax constitutes the taxpayer's only tax obligation towards Canada. In addition, carrying charges are not to be considered. Consequently, these amounts are not to be included in the return.

See Also

Income Tax Guide for Electing Under Section 216

Return as Per Section 217 – Election Pension Benefits and Other

You must identify the taxpayer's residency status on December 31 in the "Information about your residency status" section at the bottom of page 1 of the Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada. The questions in this section are from the "Residence" section of the Identification and Other Client Information.

You must also complete Schedule A, Statement of World Income and, B, Allowable Amount of Non-Refundable Tax Credits.

These schedules allow for the calculation of the personal credits to which the taxpayer is entitled. You must indicate all the taxpayer's types of income not covered by a section 217 election from both Canadian and foreign sources.

You must also complete Schedule C, Election under Section 217 of the Income Tax Act. This schedule provides a description of the income for which the election is made and is used to calculate the amount of non-resident tax as well as the tax adjustment according to Section 217, which is claimed as a deduction on line 445 of Schedule 1.

The major types of income for which a section 217 election may be made, are the following:

- Benefits under the Agreement on Automobile Products;

- Benefits under the Labour Adjustment Benefits Act;

- Certain pension benefits;

- Certain death benefits;

- Employment Insurance benefits;

- Certain retiring allowances;

- RRSP payments;

- DPSP payments;

- RRIF payments;

- Amounts received from a retirement compensation arrangement or the redemption price of a right in a retirement compensation arrangement.

An election cannot be made under section 217 with respect to support payments.

When an election is made under section 217 with respect to any of the above-mentioned types of income, the following income must also be taken into account in the return, if necessary:

- Employment income earned from Canadian sources, including tips, incentives and the amounts carried over from a previous year;

- Taxable capital gains from the disposition of taxable Canadian property;

- Income earned from a business carried on in Canada; and

- Taxable portion of scholarships and net research grants.

Revenu Québec applies the rule of 90% of income from all sources even though there is no Québec equivalent to federal Schedules A and B. The program applies the reduction of personal credits on the same basis as that of the federal, i.e. according to the results obtained from Schedules A and B.

The program taxes this income taking into account the 48% non-resident surtax and grants the personal tax credits according to Schedules A and B.

Under the Canada–U.S. Income Tax Convention, Old Age Security benefits, federal net supplements and CPP and QPP benefits paid to a U.S. resident are only taxable in the United States.

When the taxpayer receives interest income or dividends, the financial institution must be advised to make non-resident tax withholdings on this income (Part XIII tax). This tax constitutes the taxpayer's only tax obligation towards Canada. Consequently, there is no need to include the interest income or dividend amount in the return. In addition, carrying charges are not to be considered.

See Also

Electing Under Section 217 of Income Tax Act

Return Pursuant to Section 115 – Returns of a Non-Resident of Canada

The affected income is:

- Employment income earned in Canada, including tips, incentives and amounts carried over from a previous year;

- Income earned from a business carried on in Canada;

- Taxable portion of scholarships and net research grants; and

- Taxable capital gains from the sale of taxable Canadian property.

When the income is taxable in a province, you must enter "Non-resident" as the province of residence and "the applicable province of taxation" as the province of taxation.

In addition, you must complete Schedule A, Statement of World Income and B, Allowable Amount of Non-Refundable Tax Credits. These schedules allow you to calculate the personal credits to which the taxpayer is entitled. You must enter all the taxpayers types of income not listed under section 115 from both Canadian and foreign sources.

Employment income not exceeding $10,000 (Canadian) earned by a non-resident who is a U.S. resident is exempt from Canadian tax under the tax treaty.

Make sure that the residency status of the taxpayer is correctly identified in the "Residence" section of the Identification and Other Client Information. The residency status must be entered at the bottom of page 1 of the Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada if the taxpayer files a provincial return.

Return According to Section 250 – Returns of Deemed Residents of Canada

When the income is taxable in a province, you must enter "Non-resident" as the province of residence and as "the applicable province of taxation" as the province of taxation.

When the non-resident taxpayer is entitled to the amount for a spouse or common-law partner and the amount for a dependant, he or she must take into account the spouse's or child's net income from all sources for the full year even if the spouse or child does not have to file a Canadian tax return.

Moving expenses are only deductible by a full-time student.

The tax-withholding amount as per the NR4 slips must be entered on the workchart of line 437 in the T1 return.

Definitions

Non-resident: To be considered a non-resident, there must be some permanence to the taxpayer's stay abroad. If he or she leaves Canada to settle in another country and he or she severs significant residential ties with Canada, he or she is considered to be a non-resident for income tax purposes, unless he or she is a deemed resident

Deemed resident: Certain people who live outside Canada and who sever their residential ties with Canada are considered to be deemed residents of Canada for income tax purposes.

Types of deemed residents: The taxpayer may be considered a deemed resident of Canada if he or she is:

- a member of the Canadian Forces;

- a member of the Canadian Forces overseas school staff who chooses to file a return as a resident of Canada;

- a federal or provincial government employee who was resident in Canada just before being posted abroad or who received a representation allowance for the year;

- a person working under a Canadian International Development Agency (CIDA) assistance program who was resident in Canada at any time during the three-month period just before starting duties abroad;

- a dependent child of one of the first four persons described above and his or her net income for the year was not more than the basic personal amount (line 300 of Schedule 1);

- a person who, under an agreement or convention (including a tax treaty) between Canada and another country, is exempt from tax on at least 90% of his or her world income in that other country because of his or her relationship to a resident (including a deemed resident) of Canada.

Factual resident: A taxpayer is a factual resident of Canada if he or she keeps significant residential ties in Canada while living or travelling outside the country. The term factual resident means that, although he or she left Canada, a taxpayer is in fact considered to be a resident of Canada for income tax purposes.

Types of factual residents: A taxpayer may be a factual resident if he or she is:

- working temporarily outside Canada;

- teaching or attending school in another country;

- commuting from Canada and his or her place of work in the United States; or

- vacationing outside Canada.

Deemed non-resident: Since February 24, 1998, if the taxpayer is a factual resident of Canada and a resident of another country, according to a tax treaty Canada has signed with another country, he or she may be considered a deemed non-resident of Canada.

A taxpayer becomes a deemed non-resident of Canada when his or her ties with the other country become such that, under the tax treaty, he or she would be considered a resident in that other country.

If on February 24, 1998, the taxpayer was already a resident of a country with which Canada has a tax treaty, he or she is not a deemed non-resident of Canada. He or she will only be considered a deemed non-resident of Canada if after February 24, 1998:

- the taxpayer ceased to be a resident of that treaty country and then becomes a resident of that country again; or

- the taxpayer moves from that treaty country and becomes a resident of another country with which Canada has a tax treaty.

If, under a tax treaty concluded between Canada and another country, the taxpayer resides in that other country and not in Canada and, for this reason, is deemed not to reside in Canada for the year for the purpose of the federal tax system, but is deemed to have resided in Québec throughout the year on the grounds that he or she resided in Québec for a period or periods totalling 183 days or more in the year while he or she ordinarily resided outside of Canada, separate client files must be completed to prepare the federal return (as a non-resident of Canada) and the Québec return (as a deemed resident of Québec).

See Also

Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada

The marital status change or change in situation is automatically calculated by the program for the following situations:

- Breakdown or divorce in the year;

- Marriage or union in the year;

- Death in the year.

Furthermore, for Québec return purposes, you will have to indicate the date of the change if the situation on December 31, 2018, differs from the one indicated in 2017, and the change of situation occurred in 2017, but the date of change was not indicated on the 2017 return, for this taxpayer.

You must indicate the title (Mr., Mrs. or Ms.) that will be printed on the client letter as well as on page 1 of the tax return. The title indicated in this section identifies the sex of the taxpayer. The program assumes that the taxpayer is "Mr." and that the spouse or common-law partner is "Mrs."

The date of birth must be entered or else, the program assumes that the taxpayer is 40 years old.

The social insurance number refers to the social insurance number (SIN), the temporary tax number (TTN) or the individual tax number (ITN).

You may enter a different address than the taxpayers address as well as a distinct telephone number by selecting the Spouses address different from taxpayers address check box.

Complete this section if you are not preparing the spouse’s return, if the spouse has no income, or if there was a separation in the year. Enter the spouse's income for the year if you prepare his return separately from the taxpayer’s return. If there was a breakdown in the year, enter the net income of the spouse for only the period preceding the breakdown.

If no amount is entered, the spouse's income is assumed to be zero and the spouse or common-law partner amount is automatically claimed. However, if this is the case, it must be confirmed on the line "The spouse’s net income is nil or negative" in the "Spouse’s income" section of the Identification and Other Client Information form. A diagnostic message will notify you when the situation applies.

For printing purposes, you must select the The spouse was self-employed check box only when the spouse's or common-law partner's information has not been entered in the forms relating to his or her self-employment income.

The taxpayer is filing for the first time

If this is the taxpayer's first return, make sure that the check box The taxpayer is filing for the first time is selected. This box is selected by default when a date of entry is entered in the “Residence” section of Form Identification and Other Client Information (Jump Code: ID).

Same name as on the last T1 return

To indicate that the name to use is not the same as on the last federal return, ensure that the Same name as on the last T1 return check box is cleared. This box is selected by default when it is a new file. It will however, not be selected if it is indicated that the taxpayer is filing for the first time.

In the case of rolled forward files, the box will be selected if the first and last names indicated in Form Identification and Other Client Information (Jump Code: ID) are identical to the first and last names rolled forward in Form File Identifier Worksheet (Jump Code: FILE). If a change is made in Form Identification and Other Client Information, the check box will be cleared.

Note: Replacing capital letters with lowercase letters is not considered as a name change. Any other change, such as deleting accents, hyphens, spaces, etc. is considered a name change.

The taxpayer has a Tax-Free Savings Account (TFSA)

This box is optional and is not used for purposes of the return. However, you can use it in a customized filter to identify your clients who have a TSFA.

The taxpayer is a U.S. citizen

This box is optional and is not used for purposes of the return. However, you can use it in a customized filter to identify your clients who are United States residents.

Working Income Tax Benefit (WITB)

This box must be selected if the taxpayer was confined to a prison or similar institution for a period of 90 days or more during the year. Taxpayers are not eligible for the WITB if this situation applies to them.

Elections Canada

Indicate whether the taxpayer is a Canadian citizen and whether he or she allows the CRA to transfer the information to Elections Canada for the purpose of maintaining their permanent electoral list.

In rolled forward files, the answers given in the previous year will be displayed this year. For new clients, an answer must be entered, since the questions have no default answer.

Note: Your clients must answer these questions on an individual basis. Do not answer “Yes” if the address on page 1 of the T1 return is not that of the taxpayer.

Foreign Income

You must indicate whether or not the taxpayer owned or held, at any time in the year, foreign property with a total cost of more than $100,000.

Where the answer is "Yes," you must also complete and attach Form T1135 to the return.

In the case of rolled forward files, the answer given in the last year will appear this year. In the case of new clients, an answer must be entered, since the question has no default answer. The answer you provide on Form Identification and Other Client Information will be updated to page 2 of the return.

Alternative address authorization

Form T1132 allows the taxpayer to provide an alternative address where his or her notice of assessment and tax refund (if applicable and if direct deposit is not used) may be sent. Therefore, that form allows the taxpayer to provide his or her actual address on page 1 of the return and an alternative address for the above-mentioned documents. For example, a tax preparer may choose to receive tax assessments on behalf of his or her clients to make sure no assessing discrepancies are set aside inadvertently by a taxpayer, or a taxpayer may choose to receive his or her refund cheque at a different location.

Form T1132 is only valid for the current year. A new Form T1132 will have to be signed every year. In addition, the alternative address will not be used to mail GST/HST credit payments, Canada Child Tax Benefit payments (including payments from certain similar provincial or territorial programs), correspondence, or Notices of Reassessment.

This form can be used only for a paper return and must be enclosed with the return to be processed.

Taxpayer's legal representative

Enter the title and the name of the taxpayer’s representative (guardian or person to whom the taxpayer gave power of attorney, or for a deceased taxpayer, the executor or the administrator of the estate). This information is updated to the "Signature" section of Form T1013, Form T183, and Form MR-69.

For a deceased taxpayer, it is also possible to enter information relating to the address of the legal representative in Form Income Tax Returns for Deceased persons (Jump Code: DECEASED).

The following options from the Tax Preparer's Profile can be modified, for a given customer:

- Salutation for the client letter;

- Personalized salutation (if needed);

- Name of the firm or representative to appear at the bottom of the Engagement letter;

- Print a disclaimer to appear on the last page of the return and/or at the end of the financial statements. Note that this option does not modify the notice to reader appearing at the bottom of each page of the financial statements;

- Language of correspondence;

- The taxpayer paid to have the return prepared; and

- The telephone number to print.

This section enables you to set up print options that you want to use for printing a return (taxpayer and/or spouse or common-law partner and/or dependant). The options are the following:

- T1 return;

- TP1 return;

- Print language;

- Confidential return when using the Taxprep Print Service.

The information entered in this section is posted to the provincial and territorial credits (Form 428 or 479). Completing this section facilitates the data entry and calculation of Form 428 or 479.

The information in this section differs depending on the province or territory of residence entered in the "Residency Status" section.

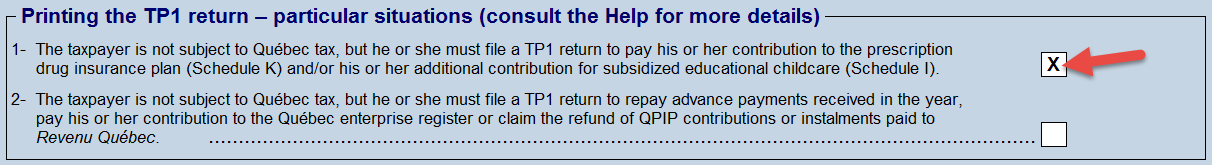

In certain situations, a taxpayer not subject to Québec income tax might still have to file a TP1 return, and net income might have to be reported on line 275 of this return.

Taxprep provides an option allowing the TP1 return to be applicable (as well as the related bar codes) even for taxpayers who are not subject to Québec income tax.

Here are the situations in which a TP1 return should be filed with Revenu Québec even if the taxpayer is not subject to Québec income tax:

Situation no. 1:

The taxpayer left Québec during the year, but has to pay one or both of the following premiums, based on his or her net income indicated on line 275:

- a contribution to the prescription drug insurance plan (Schedule K); and/or

- an additional subsidized educational childcare contribution (Schedule I).

Even if he or she no longer resides in Québec, a taxpayer who has to pay these contributions must file a TP1 return reporting his or her net income on line 275, but no taxable income on line 299. The net income must be provided in order for Schedule K and/or Schedule I to be completed correctly. These schedules will then have to be attached to the TP1 return.

A section entitled “Printing the TP1 return – particular situations” displays at the bottom of Form Identification and Other Client Information (Jump Code: ID) when the taxpayer is not subject to Québec income tax.

When the taxpayer must pay one of the above-mentioned contributions (or both), box 1, depicted below, will have to be selected in the active client file (i.e. the file in which the federal return (T1) has been completed).

This will make the TP1 return applicable (as well as the related bar codes and business statements). The net income will be calculated, but the taxable income reported on the TP1 return will be nil. Schedule K and/or Schedule I will also become applicable once completed. The TP1 return and related schedules will print if you use the “GOVT” print format.

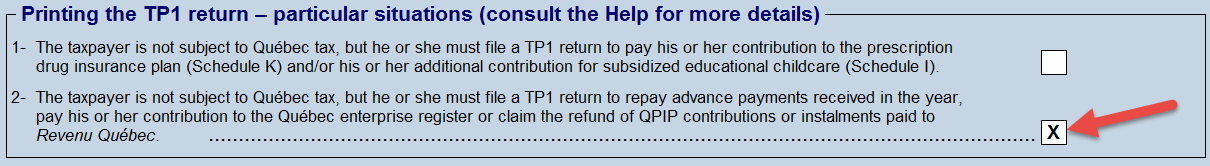

Situation no. 2:

The taxpayer must file a TP1 return with no income to pay or refund certain amounts, or to request the repayment of certain amounts.

|

Examples:

|

For the examples provided with regards to situation no. 2, create a new blank client file. Do not include any income in this return; complete only the “Identification,” “Mailing address” and “Residence” sections of the ID form. Then, select option 2 in the “Printing the TP1 return – particular situations” section. This will make the TP1 return applicable (as well as the related bar codes).

Finally, complete lines 436, 437, 438, 441, 453 and/or 457 of the TP1 return, depending on the taxpayer’s situation. The TP1 return will print if you use the “GOVT” print format.

The cells in this section are provided solely to assist you in keeping track of your returns. This information is not required and will not appear on the tax return nor will it be transmitted for EFILE purposes.

See Also